Bitcoin automates global settlement in a manner that is analogous to that of robotization. This involves exchanging human bean counters, who require a significant amount of energy, for bean guessers, which are more efficient, cost-effective, and have a more transparent energy bill.

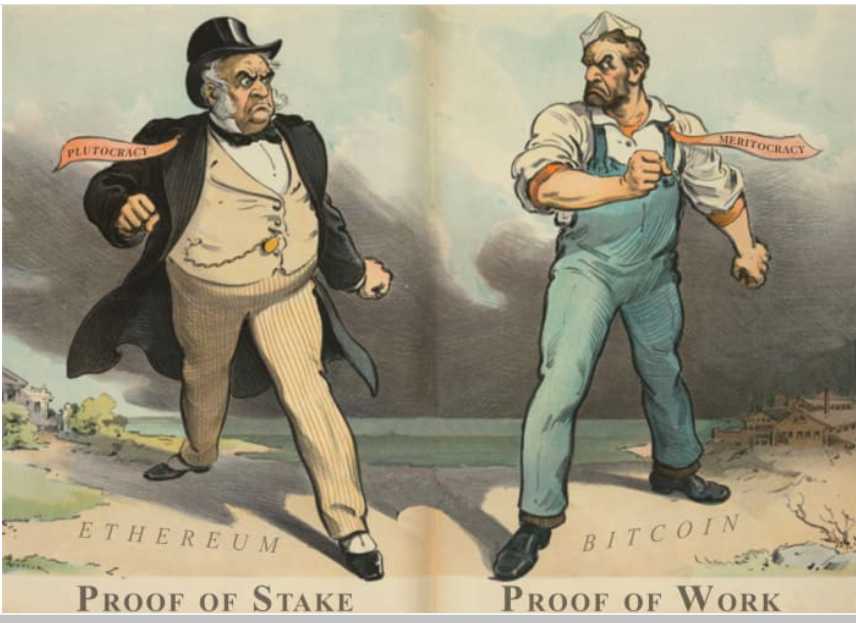

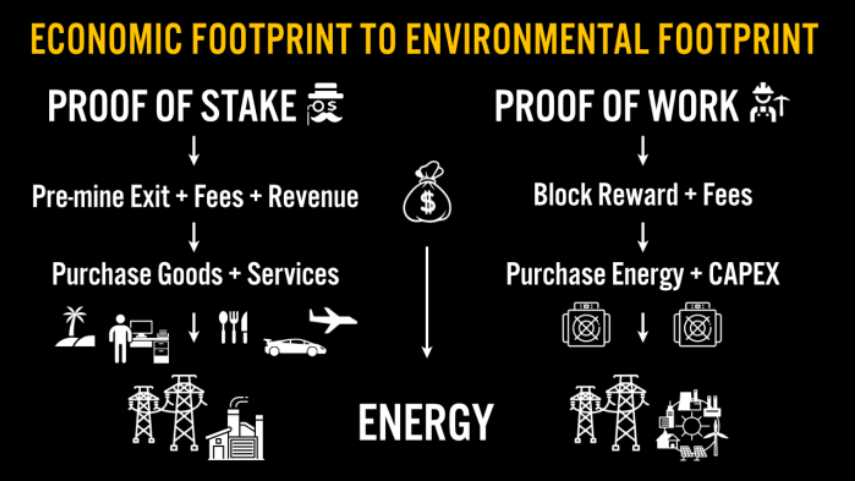

It is a fallacy to believe that Ethereum's recent "Merge," in which proof of work was replaced by proof of stake, brought to a reduction in energy consumption of 99.95 percent. Ignore the fact that this figure does not take into account expensive enterprise server farms, organizations, or the increased amount of effort that is required to successfully complete proof of stake transactions on a global scale. Follow the money: the price of carrying out a transaction has not significantly decreased. It is not anticipated that fees will decrease, and any portion of the security budget that was formerly used to purchase energy for machines will instead be used to purchase energy for Ethereum's ruling class, which will effectively nullify a significant portion of the cost savings brought about by Ethereum's reduced energy consumption.

The only environmental benefit of proof of stake is that it obscures the energy expenditures that people make in order to enable its validating infrastructure. This is in contrast to proof of work, which encourages the development of renewable energy and lowers waste methane emissions. The neo-Luddite view that replacing inefficient humans and their infrastructure with cheap and energy-intensive machinery is a net negative lends credence to the environmental myth of evidence of stake. This is a philosophy that dates back to the early days of the Industrial Revolution.

The Age of Slackers and Luddites

During the Luddite Rebellion (1811–1816), Ned Ludd was the driving force behind a group of highly trained English textile workers who opposed modernisation and sought to destroy a specific form of mechanized textile machine that they believed to be "hurtful to mankind." The concept of commonality linked to the concept of the common good, much as the concept of the tradition of the commons. It was believed that the machines posed a danger to both the communities and the employment that were slated to be eliminated in the future. These innovative textile machines have the potential to work more efficiently, more quickly, and for a lower cost than any group of expert artisans. It was believed that the machines would also cause widespread unemployment in the society, which would further contribute to unequal power relations. In order to voice their opposition to this new form of technology, the Luddites damaged the equipment and attacked the people who owned it.

1884 edition of the penny magazine was the source.

The Luddites' worst worries were eventually disproved by time. Employment opportunities are not going to be eliminated by technological automation. On the contrary, it liberated human beings to devote their time and energy to activities that were more productive and creative. The significant rise in the quantity of raw resources resulted in an increase in the amount of labor required to produce increasingly complex goods at an affordable price. Technology that is powered by economic energy can improve living standards, lead to a rise in wealth, and create additional job possibilities.

Gains to Be Obtained Through Automation

The technique of replacing human labor with energy-intensive machines has been around for centuries. In the year 1582, the carrying capacity of the English merchant fleet was 68,000 tons, and it required 16,000 sailors to operate. Commercial fees were used to acquire energy for the purpose of providing tens of thousands of sailors and their families with food, ale, clothing, heat, and medication. This was accomplished through the acquisition of goods. Concerns regarding security, efficiency, safety, and reliability were voiced repeatedly in relation to these fleets.

In today's worldwide shipping industry, machinery that require a lot of energy are used, although there are very few people involved. When it was delivered in 2017, the container ship OOCL Hong Kong was the largest container ship that had ever been built. It has the capacity to carry 200,000 tons while only requiring a crew of 22 people. Instead of finding new sources of electricity to keep populations of sailors alive, we construct devices that use energy and free people from performing menial and mechanical labor. Because of this, people are able to perform jobs that are more productive, which in turn enables human flourishing.

The commerce fleets of the Middle Ages were not nearly as efficient or dependable as those of today's modern, energy-intensive container ships, which are orders of magnitude more effective. Simply assuming that container ships are wasteful due to the fact that they consume more energy than sailing ships is a foolish assumption to make. Machines, despite the fact that they demand a lot of energy, replace the energy-intensive requirements that humans have, allowing humans to focus their abilities on other activities.

The Proof Of Work System Is A New Development In Technology

Proof of work makes use of energy-intensive machines, which puts people working in traditional finance out of work. This frees them up to do more productive things for society, which in turn allows them to acquire the ability to buy energy-intensive activities. Proof of work is a prerequisite for cryptocurrencies, which are used to purchase energy-intensive activities. The energy-intensive work of global settlement moves to smaller groups of miners in rural communities that have access to stranded power, reversing some of the destructive power relationships that Luddites rebelled against more than a century ago. Outdated finance jobs become automated, and the work of global settlement moves to smaller groups of miners.

We now have energy-intensive proof-of-work mining machines, which every 10 minutes make an educated guess as to the number of beans required for global settlement. This eliminates the need for massive buildings full of energy-consuming bean counters, which were protected and supported by energy-intensive governments and militaries all over the world. This method provides dependable, non-stop, worldwide settlement without prejudice and without rest at a significantly lower total cost.

Legacy technology is used to demonstrate proof of stake.

The proof of stake protocol is an outdated piece of technology; there is nothing innovative about it. It is a time-honored method of fairness and governance that has been put into practice for many decades. Because proof-of-stake assets have a tendency to amass in large financial institutions, these institutions are an attractive target for regulatory capture. This, in turn, necessitates more human labor to assure compliance and maintain control, which in turn leads to increasing fees. The only approach that can minimize or abolish antiquated oligopolistic governance and coercive levies while simultaneously insuring censorship resistance is the method of physical labor performed by machines contending over actual global resources.

Vitalik Buterin, one of the co-founders of Ethereum, was boasting about Ethereum's potential to one day have a larger security budget than Bitcoin in a recent interview with Noah Smith. The interview was conducted by Noah Smith. This is an admission on his part, albeit an implicit one, that he anticipates that Ethereum's elite auditors will have a significantly greater capacity to purchase energy than Bitcoin miners do. After all, the ability to purchase energy is entirely constrained by a network's defense budget, which is comprised of the fees, prizes, and revenue that are derived from the network's users.

In this light, it is possible to see that proof of stake is a group of wealthy elites — a new breed of bankers running an inefficient database — that is extracting greater shares of revenue and charging high fees in order to make their time and efforts worthwhile. These elite insiders don’t want you to consider that security budgets and pre-mined income will be used to buy their own energy. Whether the energy is purchased for humans or machines doesn’t make much difference beyond feel-good corporate carbon accounting. The environment doesn’t care about accounting tricks.

The relatively low cost of Ethereum's energy consumption serves as a distraction from the platform's budget allocations for information security. It is an ESG sleight of hand — a ruse on the gullible and environmentally conscious. You’ll pay high fees to move your money and Ethereum’s elite will rake in profits to buy yachts, sports cars and carbon-intensive services — laughing all the way to their own bank.

Budgets for Defense Also Serve as Budgets for Energy

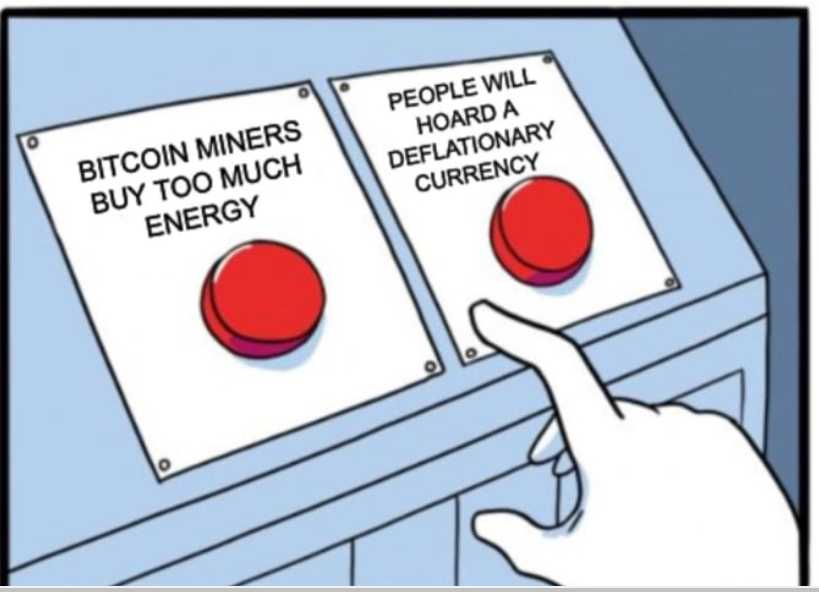

The reward for solving a Bitcoin block will be cut in half every four years, which means that miners will be supported more and more by the fees that users are willing to pay for open and global settlement. Buterin believes that network activity and fees will decrease as a result of the disinflationary nature of Bitcoin, which motivates users to save money rather than spend it. He neglects to mention that in such a scenario, miners would not have the financial means to purchase very much energy, and as a result, they would reach a consumption equilibrium, similar to what has occurred with each and every automated technology throughout the course of human history.

If Buterin's prediction comes true, an Ethereum with a larger security budget than Bitcoin's would allow Ethereum's elite to purchase more energy than Bitcoin miners. Enriching proof-of-stake validators for energy degrowth will not help humanity progress or solve environmental problems; rather, it will only obscure the carbon-intensive energy that its insiders will purchase with their high security budgets. This is because of the nature of the degrowth process.

It would be much better for humanity to focus on economically overbuilding cheap, renewable power for a future that will require significantly more energy as a greater number of services are electrified rather than encouraging degrowth of services. This is because the future will require significantly more energy. In the event that Buterin's forecasts are accurate and the power consumption of Bitcoin decreases in tandem with the issuance of new coins, excess renewable energy may be repurposed for use in other contexts.

Revenues And Energy

It goes without saying that one dollar in revenue does not equal one dollar in energy purchases, especially considering Bitcoin's prowess at locating the cheapest energy available during periods of low demand. However, even if all of the beneficiaries of Ethereum's pre-mine, high fees, and staking rewards live lifestyles that produce low levels of carbon emissions, the money can and will likely flow into activities that produce high levels of carbon emissions.

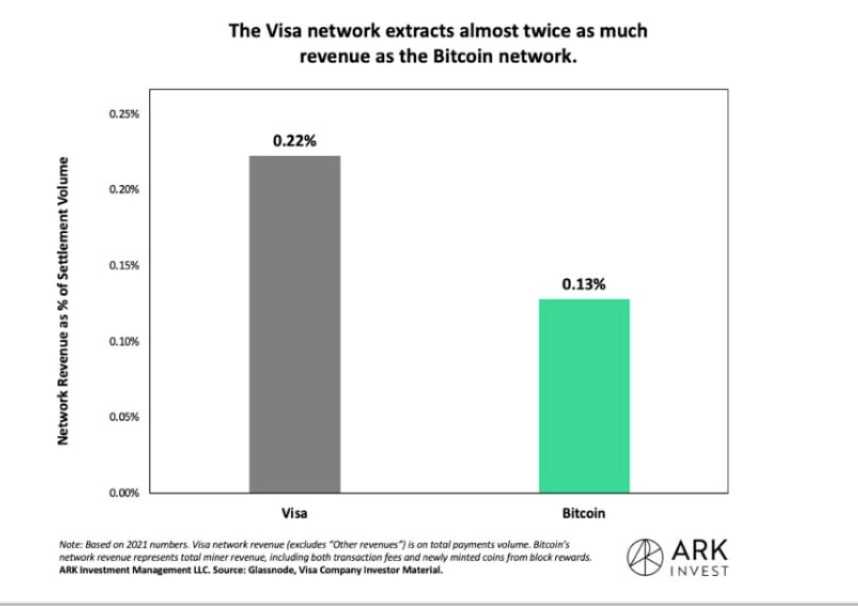

When combined, Visa, Mastercard, and American Express use less than 1% of the electricity that Bitcoin does in a single year. The complete picture is however obscured by the energy consumption of businesses. These companies pay their employees large salaries, which are then spent on activities that require a significant amount of energy, for a job that machines can do more quickly, at a lower cost, and continuously. Payments made at traditional retailers take several days to clear, and this process does not take place at all on public holidays; in contrast, Bitcoin transactions clear consistently every ten minutes. The amount of money that a payment rail makes off of its customers is a good indicator of the amount of resources that it actually uses up.

If Amazon was able to economically replace nearly all of its warehouse employees with robots, then the company's higher energy bill might be seen as an environmental disaster by some. On the other hand, raw energy would be consumed by robots rather than by humans, who would no longer receive a wage to spend on energy. There is no way around the fact that all of these activities involve the purchase of energy in some form or another.

Bitcoin automates global settlement in a manner that is analogous to that of robotization. This involves exchanging human bean counters, who require a significant amount of energy, for bean guessers, which are more efficient, cost-effective, and have a more transparent energy bill.

As Nikola Tesla hypothesized more than a century ago, the time and effort savings afforded by machines contribute to human advancement while simultaneously driving up the demand for energy. As a result of cost savings brought about by efficiencies, people now have the ability to consume more resources. Proof of work was his embodiment of the vision that it was imperative to keep humanity moving forward by enabling cheaper and cleaner forms of energy. He believed this to be an imperative.

Engineering Obstacles Can Be Defined As Environmental Problems

Accounting for carbon emissions by corporations obviously does not take into account the flow of money from a company into the human consumers of energy produced by that company. If it did, it would be immediately obvious that carbon accounting that is based on corporations is nothing more than window dressing and that there is no plan in place to successfully provide affordable renewable energy to all of humanity. Instead, the goal is to get wealthy people to brag about how environmentally friendly their businesses are in order to fleece more money out of consumers so that they can spend their windfall on activities that require a lot of energy. This will not in any way advance humanity or provide a solution to the real environmental problems that we face.

The fact of the matter is that environmental issues are frequently engineering problems, which Luddism and degrowth are unable to solve. Countries that want to meet their climate goals need to electrify their economies and generate three times as much electricity from renewable sources as they do now. It is estimated that approximately one-third of all energy that is produced is lost, and only one industry can monetize the 0.15% of the world's energy that is least valuable.

Bitcoin is a pioneering species that helps unlock oases of energy in energy deserts for future uses and can help balance the demand for renewable sources of energy. In comparison to other industries, it has the highest percentage of renewable energy usage. Proof of work is the only way to monetize methane emissions, grow greener flowers, make stranded landfill gas more economically viable, capture energy from refuse tires, and unlock the power of the ocean for a billion people. Those goals are ambitious, but proof of work is the only way to achieve them.

Only proof of work has the potential to have a carbon footprint that is less than zero at the end of the next decade, according to people who are fascinated by the wonders of carbon accounting. The responsible progression of humanity is directly correlated to the successful conversion of waste into energy. The monetization of energy needs to be increased, not decreased.

Efficiency in energy consumption is the key to human advancement. Additionally, it is an indication of the value that users are willing to pay for. [Case in point:] Greenpeace and the "Change the Code" campaign are two organizations that are opposed to the proof-of-work mining method used by Bitcoin. These organizations want you to believe that saving the environment will result in the enrichment of a new breed of bankers. Either they haven't taken the time to consider what it actually takes to incentivize responsible stewardship, or they have a conflict of interest with those who are marketing a Luddite myth. Both explanations are possible.

Enemma Nkeiruka 1 y

Great