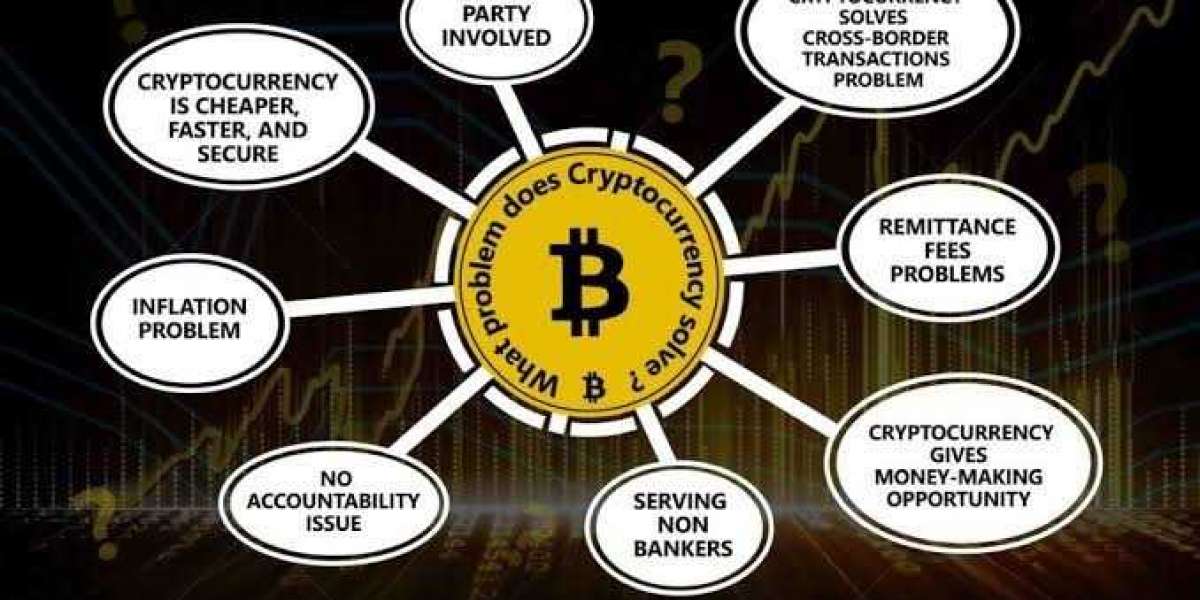

I've concentrated especially on using cryptocurrencies' unique capabilities to solve issues with our current monetary system.I believe you'll find it enjoyable and useful.

1. The inflation (aka Currency Debasement)

What a country's currency used to purchase has changed. Fiat currencies have a basic flaw in that governments and central banks may readily raise any currency's circulating money supply by manipulating interest rates and issuing bonds (debt). While the greater supply tends to temporarily increase market liquidity, it also reduces the purchase power of anyone holding that currency.

How severe has this degradation been over time? The astonishing picture that follows illustrates how the US dollar has declined over the past century:

In many ways, inflation serves as a covert taxing mechanism that funds political promises. If more money can be printed, the amount of currency in circulation will increase.

Cryptocurrencies, as opposed to conventional currencies, allow for a defined generation schedule and a maximum supply that is hard capped. The maximum supply for two prominent cryptocurrencies, Bitcoin and Decred, is 21 million units. A game-changing innovation that is just not achievable with fiat currencies is a currency with a fixed supply that cannot be diluted.

Value arises from scarcity. Because of its perceived scarcity, gold has been a reliable store of value for more than 5,000 years. But a mathematically controlled supply, which cryptocurrencies have suddenly made feasible, is the best guarantee of scarcity there is.

2. Exchange rates fees

Consider a scenario in which each retail establishment had its own currency, and you had to give up 30% of its worth in order to spend it in the store next door. This has a macro level similarity to what happens with fiat currency. People who possess different currencies are discouraged from doing business with one another because there are 180 recognized currencies by the UN. Foreign exchange costs, which were until now inescapable, are arguably the most pointless surcharges on persons doing business with one another.

Territorial boundaries provide artificial limitations on the currencies that central banks issue. If you've ever traveled abroad, it's probable that you came home with spare change that is practically useless. On the other hand, cryptocurrencies are by definition borderless. Remember that there is now a better option accessible to us the next time you are charged international exchange costs or find yourself with useless foreign spare change.

3. ineffective payment transaction

Moving around fiat money is inefficient. As a result, we must rely on a number of middlemen, who each keep a portion of the profits in order to transfer money to the following receiver. I've seen firsthand how ineffective the current correspondent banking structure is while working in the financial services industry. It could take up to five days (!) for the beneficiary of a wire transfer to another nation to be able to access the funds. We are told that these middlemen are the dependable stewards of the walled money system, which justifies their exorbitant fees and protracted settlement delays.

4. restricted division and incompatible with micropayments (future use case)

Which fraction of a dollar is the smallest? Even if the number may theoretically be smaller, under the current system of paper and coin money, the answer would be $0.01. In theory, we should be able to conduct transactions in fractions of a cent, a half-cent, or even a tenth of a cent. These limitations are artificial.

Unlike fiat money, a bitcoin may be split into 100 million units (0.00000001 BTC, also known as a Sat). Although the application of micropayments is not yet clear, there are growing indications with the Internet of Things that intelligent devices will engage in commerce. There will be chances to make money off of microevents as more smart gadgets connect to the internet.

Mimi 12 hrs

Great 👍