Although they are much less likely to cost you one of your limbs, bear traps in trading are just as unpleasant to fall into as those in real life.However, they may drain your funds.

How Does a Bear Trap Work?

When the price of an asset on the cryptocurrency or stock market incorrectly shows a reversal of an upward trend to a downward trend, this is known as a bear trap in trading. A bear trap is a false technical pattern.Bear traps and short squeezes are similar, but their price rallies are typically smaller and take longer to start.

Simply put, a bear trap is a fictitious price drop that is typically orchestrated by one or more traders to induce other market participants, primarily novice investors, to sell a specific asset.Bears traders who want to profit from a price drop or a downward trend are caught in this trap, which is why it is referred to as this.

How is bear trap trading carried out?

Bear traps erroneously indicate a bearish trend, deceiving some traders into believing that a prolonged price decline may be imminent.Bear traps can occur naturally, but the majority of the time, they occur on the market as a result of coordinated actions taken by institutional investors or other significant players, such as crypto whales.

When a large number of institutional and/or experienced traders on the market want an asset's price to rise, this is known as an orchestrated bear trap.They sell a lot of the aforementioned asset with the intention of increasing the buying pressure and decreasing the potential selling pressure in order to accomplish this.As a result, prices fall, which may deter inexperienced traders.As a result, they might end up selling their stocks, fiat, or cryptocurrencies to reduce their losses in anticipation of further price drops.

However, there will be a lot of traders looking to buy in as the buying pressure increases, resulting in a sudden price reversal.In addition, the same inexperienced traders will be forced to repurchase the stock they sold due to FOMO.The prices of the involved asset will rise as demand increases, allowing experienced traders to profit.

Bear traps can also catch some seasoned traders, but in a different way.The unaware, inattentive, or simply non-institutional short-sellers who see the downward trend as an opportunity to open short positions only to receive a margin call when prices rise are especially vulnerable to this kind of trap.Typically, short-sellers are the only ones who can profit from a bear trap if they either foresee or spot it before it begins and trade accordingly.

Cryptocurrency markets are well-known for being manipulable.Since cryptocurrency trading has a lower entry barrier and higher potential for profits than forex or stocks, many traders are novices.Whales are able to communicate and organize bear traps without fear of repercussions due to the lack of regulation in the cryptocurrency industry, which also contributes to the fact that bear traps—as well as bull traps—are quite simple to set up.

Is this a bear market for cryptocurrency?

Yes, per official count.Bear markets are typically characterized by a 20% decline from the peak and a general bearish sentiment in the market.

Markets are scary right now, but investors don't have to sit back and watch. Even though the situation is likely to get worse, they shouldn't.In point of fact, history has demonstrated that a time when no one is talking about Bitcoin is one of the best times to buy Bitcoin (BTC).

Do you recall the crypto winter of 2018–2020?No one, not even the mainstream media, was speaking favorably or negatively about cryptocurrency.Smart investors were building up assets in anticipation of the next bull trend during this prolonged downtrend and sideways chop.

Obviously, no one knew "when" this parabolic advance would occur; however, the example was only intended to demonstrate that, despite the fact that the cryptocurrency market may be in a crabbed state, there are still excellent ways to invest in Bitcoin.

Take a look at these choices:

Dollar-cost averaging for accumulation When it comes to investing in assets over the long term, it is helpful to be price agnostic.An investor who is price agnostic is immune to fluctuations in value and will continue to hold positions in a few assets they believe in.Dollar-cost average (DCA) into a position makes more sense if the project has sound fundamentals, a robust, active use case, and a sound network.

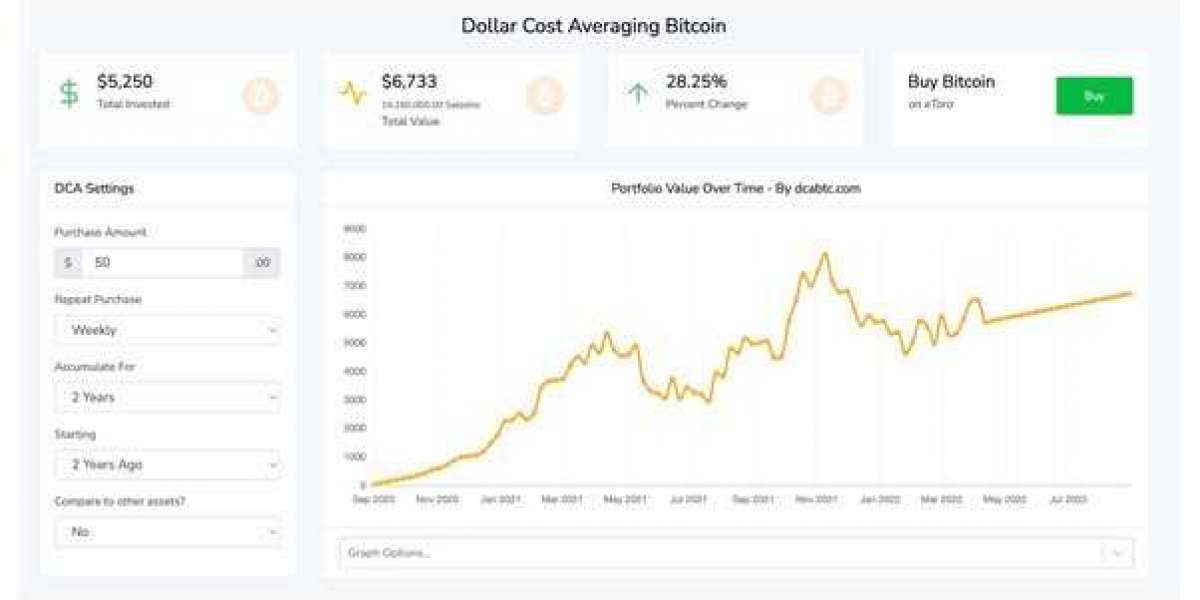

Take this DCA.BTC chart, for instance.

Investors who set up an auto-purchase of $50 in Bitcoin every week for two years are still making money today. With DCA, there is no need to make trades, monitor charts, or deal with the emotional stress that comes with trading.

Traders can use automated chart pattern signals to go long (or "Buy") and short (or "Short Sell") on cryptocurrencies by using patterns as signals to buy and sell.

They will have a portfolio with Long and Short positions that is fairly market neutral.As a result, investors will benefit at least in one direction if a market moves dramatically in either direction.If the market goes down 20%, the traders' Short book should make a lot of money, which should make up for the losses in his Long book.

Last but not least, take care of your risk management:

1) the right size of the position, 2) how to use stop loss orders, and 3) the risk-to-reward ratio

Mimi 22 hrs

Good