This was followed by a weak rally up after the FOMC of the Fed pointed out the bearish situation. As the video at the bottom of this post explains, the price structure and market rotation sequence of the current market growth are similar to those of the 2008 global financial crisis.

Using the Wyckoff Method to Find the Bright Side

After a drop of more than 10 percent in 6 trading periods, the SP 500 is in a vulnerable spot where a stock market crash could easily happen. Over the weekend, Bitcoin broke below the support at 20000. This meant that people were willing to take less risk heading into the coming week.

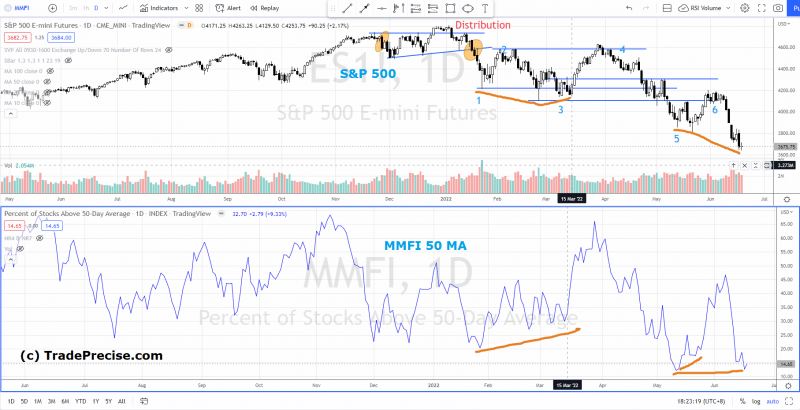

But there may be a silver lining to the looming stock market crash if you use the Wyckoff trading method to spot the signs of a possible short-term rally. Check out the chart below.

Since the short-term support at 4080 broke on June 9, 2022, the pullback has slowed down (shown in blue) and the number of pullbacks has decreased, which shows that the down momentum has run out.

A rally out of an oversold scenario may be possible for the SP 500, which is currently testing the down channel's oversold line. The bounce off the oversold line of the channel happened before on January 24, February 24, and May 20, 2022.

MORE ARTICLES

Stellantis will stop giving Canadians the COVID-19 vaccine on June 25.

See pictures of the 2023 Honda HR-V

According to the Level and Figure chart, the two value targets are 3900 and then 3650. For one month in May 2022, once the primary value target of 3900 was reached, the SP 500 halted the down transfer. When the second price goal is reached at 3650, it gives SP 500 a chance to try to rally, based on the technical details described above.

Even if the SP 500 starts to go up, as shown by the green line, it's important to watch how the price reacts at key levels like 3800 and the hole resistance zone near 3900. (annotated in pink line). Any failure along the way could mean that the rebound is over and that a sudden drop is about to start.

THE STORY GOES ON

Unless a short-term rebound occurs, a break below the current low at 3640 and a commitment below the oversold line of the down channel might trigger a capitulation, which could end in a stock market disaster similar to 2008's situation as discussed in the video at the bottom of this post.

Bullish divergence between the SP 500 and the market breadth

As the chart below shows, there was a bullish difference between the SP 500 and the market breadth (the percentage of shares above their 50-day average).

There was a positive divergence (annotated in orange) between the end of January 2022 and the middle of March 2022, when the market breadth formed a better low while the SP 500 formed a lower low. After the bullish divergence, the market went up in a big way.

An aid rally that targeted resistance near 4200 shaped a bullish divergence between 12 and 20 May 2022 as well.

From Could until now, a possible bullish divergence has been building up. If the SP 500 went up a lot, it would be the third profitable bullish divergence.

Comparing the crash of the stock market in 2022 and 2008

When the silver lining fails along the way and even at the start, the SP 500 is likely to go into market crash mode, just like the global financial crisis in 2008.

Watch the video below to see how the price structure and the market rotation sequence of the 2008 stock market crash are similar.

Alphonsus Odumu 5 w

Stock market news