Advertisement

nbsp

nbsp

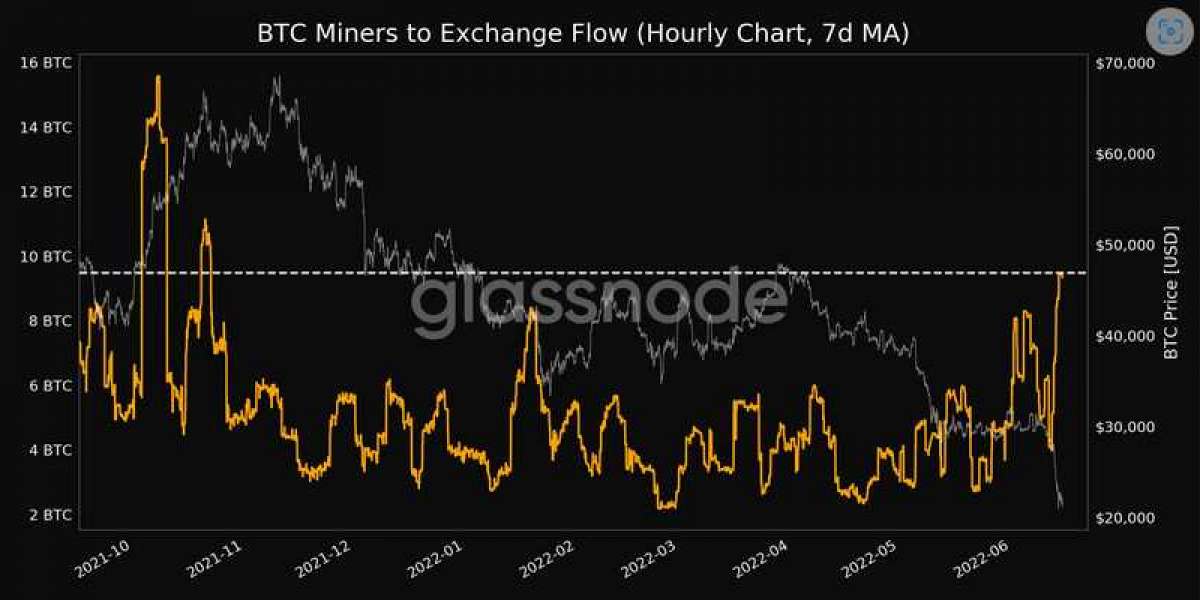

With a seven-month high of 9,476 BTC, the Bitcoin Miners to Exchange Flow chart on Glassnode shows the outflow from miner-held wallets into exchange-held wallets has increased significantly.

Mining awards and earnings are worth a lot to miners, so when they start sending more coins to exchanges, it's a sign that they're worried about losing their hard-earned money and are thus looking to sell their coins. As a broad indicator of market mood, this is an indication that sellers are still in control of the market.

Profitability in the mining industry is decreasing.

Amidst a 75% dip in Bitcoin mining profitability since its all-time high, revenues have decreased as production costs have increased.

Bitcoin Puel Multiple Chart, released by Glassnode on Friday, measures the market's profitability from a miner's point of view. The Puell Multiple falls below 0.5 during the last phases of a protracted bear market. Having entered the surrender zone, this measure is currently at 0.39.

Advertisement

nbsp

nbsp

Miners are making just 39% of a year's typical USD income, which is the lowest amount since the November 2018 meltdown. As a result, mining each coin using USD is becoming more and more expensive, and the reward in US dollars has been decreasing, which may be a hint of impending miner capitulation.

Perceived Setbacks Indulge in New Highs

Elsewhere, BTC's growing realized losses continue to push the market down, and the risk of key players going bankrupt is slowly becoming clearer. This past week, the highest USD-denominated Realized Loss in Bitcoin history was secured by investors. This week, the BTC spent on-chain realized net losses of almost $4.23 billion, exceeding all large sell-offs in 2021 and 2020.

MORE ARTICLES

It has been reported that FTX is considering buying a stake in BlockFi.

After spoofing an exploit, Convex Finance has launched two URLs.

The CEO of Binance says that Bitcoin may not reach its all-time high for another two years.

There is currently a huge amount of unrealized losses being held by long-term holders, according to onchain data. Compared to short-term holders, this bunch is spending coins with a higher, but still marginally lucrative, cost basis. Before the market reaches a final bottom based on historical data, this has previously foreshadowed the beginning of "the last wash-out period of all remaining sellers."

As a result, it remains to be seen if BTC will fall 80 to 90 percent from its November peak. After a 3% spike in the last 24 hours, BTC is currently trading at $21,397 on CoinGecko.

According to a new analysis by Glassnode, the coin's value has fallen by 71% from its all-time high of $69,044 so far, and any further dip might keep the price stranded in 2017 territory for the next 8-24 months.

Desmond 1 y

Wow