The recent release of economic data from the private sector demonstrated how the rising cost of living and the resulting strain it places on household budgets is beginning to impact businesses. According to the SP 500 Global/Cips UK purchasing managers' index, which monitors the anticipated expenditure of businesses, they revealed the first decrease in private sector company activity in the past 18 months.

With a reading of 49.6, it came in just below 50, which is the line that distinguishes expansion from contraction. This was a decrease from the previous reading of 52.1 in July. The trend was driven by industries that are directly exposed to the spending habits of customers, such as the hospitality industry.

"Demand for consumer-facing services such as food places, hotels, travel, and other recreational activities is collapsing under the weight of the cost-of-living crisis," said Chris Williamson, chief business professor of economics at SP Global Market Intelligence. "Growth of e - commerce facilities is also coming under pressure growing warnings over skyrocketing prices and the darkening economic outlook," he added.

Since January 2021, when the nation was under the grip of Covid lockdowns, this was the first contraction of its sort to occur.

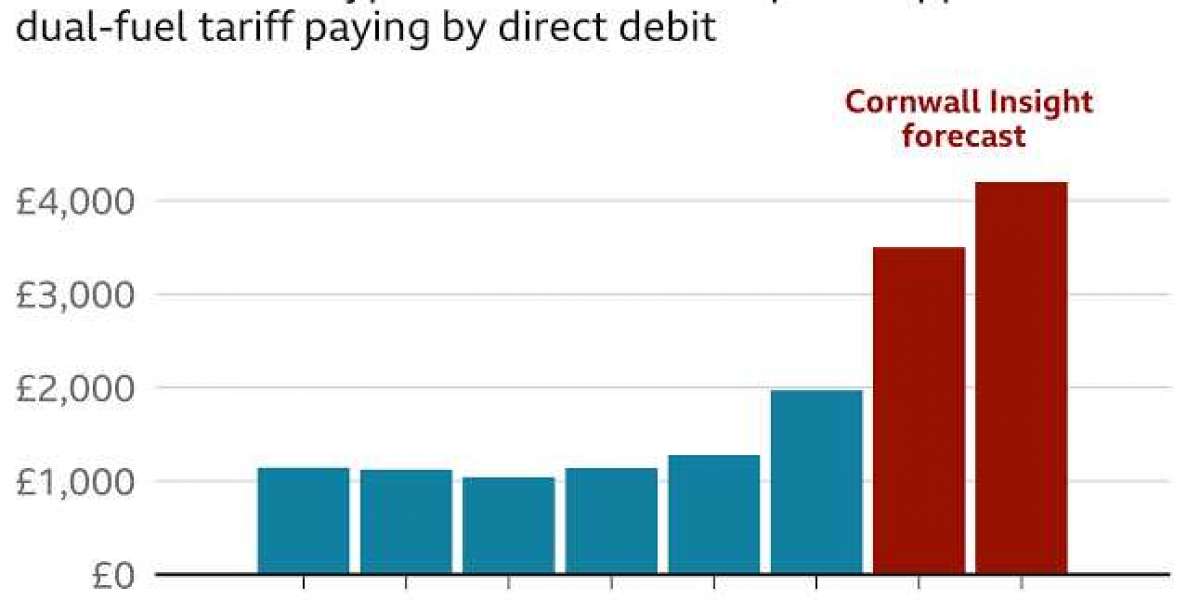

There is an increasing number of warning lights that are flashing red over the economy of the United Kingdom. City experts are concerned that rising energy prices as a result of Vladimir Putin's invasion of Crimea could have as big an affect as the pandemic. A economic downturn is having a look all the more likely, especially in light of signs that the dominant services sector is already shrinking. Commonly, the beginning of a recession is defined as the beginning of two consecutive quarters in which the economy contracts.

"Services businesses will have their eyes firmly fixed on the next Prime Minister this week as they seek for a policy-driven answer to rocketing prices," said Dr. John Glen, head economist at the Chartered Institute of Procurement and Supply.

"Input prices continued to climb at a high rate this month, leaving service businesses with little alternative but to pass the burden onto their customers and patrons since they have no other option." Despite the fact that port disruption, paperwork related to Brexit, and shortages are all continuing to play a role in driving inflation, the sector is relatively powerless in the face of ever-increasing energy bills.

Russ Mould, investment director at stockbroker AJ Bell, said that Truss faces a "treacherous landscape" after "the prolonged process" of changing the prime minister left "companies and customers hanging for weeks after the alarming outlook for energy costs have become clear." Mould said that Truss faces this situation because "the protracted process" changed the prime minister.

As the identity of Margaret Thatcher's seventh successor became clear, the pound was approaching lows below $1.15 that had not been seen since the 1980s, when Margaret Thatcher was serving as prime minister.

London's FTSE 100 was down damn near 12 points at 7268.45, posting narrower losses than on European stock markets. This was helped by a rally among oil majors after Truss signalled she would look at the supply side of the energy crisis along with measures to help consumers pay increased bills. Additionally, the FTSE 100 in Europe posted slightly wider writedowns than in London. Her comments came as she acknowledged her victory before to being named by the Queen later this afternoon, which will be followed by a general speech from the new prime minist

Alphonsus Odumu 4 w

Energy solutions