All of these things happened at Ethereum prices while DeFi was in the process of buzzing, attracting superior engagement levels, servicing noncustodial transactions, and liquidating in line with secured credit paperwork.

FTX in its Ruins

Ray continued to sift through the charred remains of the empire that Sam Bankman-Fried had built (without using harsh words along the way). The data analysis clearly illustrates the significant differences between FTX and other systems such as Aave and Uniswap. For example, during the course of the past week, Aave has witnessed an unprecedented spike in activity.

Within the space of an hour, one might begin earning returns of more than 73% while using a GUSD stable currency.

Gemini said that the postponement of backdowns from Earn productions will take place. Genesis, the lender for Gemini Earn, put a stop on withdrawals because of an ongoing issue in the FTX market, which resulted in these hold ups. After selling their GUSD assets, users came back to Avenue and began retrieving their goods in large numbers.

The liquidity of the platform increased immediately after these two events got underway, which caused lending rates to skyrocket. Always bear in mind that the supply and demand theory is the overarching premise that governs the operation of virtually all of these decentralized lending platforms. When there is an increase in supply, interest rates go down.

The causes of a significant number of backlogs

The users, in effect, got real-world payoffs for the brief period during which their goods were considered to be hazardous by other users of the marketplace. The worst-case scenario, which is not very likely to actually occur in real life, is that the Gemini stablecoin might crash, and Aave might decide to hold a vote to close down that very marketplace. However, this is not very likely to occur.

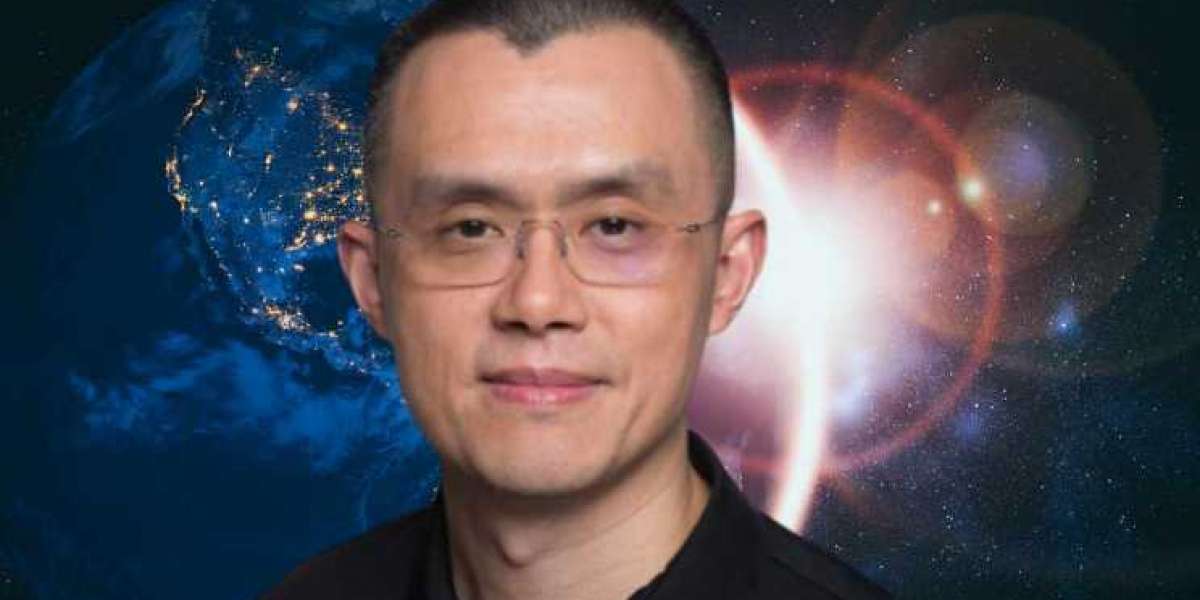

In any event, the chief executive officer, who was also a co-creator of the project, will be the one to decide how this will be carried out.

In the midst of the FTX craze, the most well-known decentralized DeFi exchange, Uniswap, has surpassed Coinbase in terms of day-to-day exchange levels for ETH pairs. Coinbase was previously the leader in this regard.

Another effect of the unrest on FTX is that users are now employing noncustodial options to withdraw currency from trading platforms and to conduct trades using their own funds. This is an effect of the unrest on FTX. They are a fiercely competitive decentralized exchange, and as a result, they have built up a substantial trading volume.

Alphonsus Odumu 5 w

Decentralized finance