In the bustling city of 06519, finding affordable auto insurance can be a game-changer for residents looking to save money without compromising on coverage. Navigating the complex world of insurance policies and discounts requires a strategic approach. This ultimate guide is designed to help you unlock substantial savings on your auto insurance while ensuring you have the protection you need.

Understanding Your Coverage Needs:

Before diving into the world of affordable auto insurance, it's crucial to understand your coverage needs. Assess factors such as your driving habits, the type of vehicle you own, and your budget. This self-awareness will guide you in selecting the right coverage without overpaying for unnecessary features.

Here are some key considerations:

Driving Habits:

- Evaluate how often you drive and for what purposes. If you have a long daily commute, you may want more extensive coverage than someone who primarily uses their car for short trips.

Type of Vehicle:

- The type of vehicle you own can impact your insurance needs. A brand-new, expensive car may require comprehensive coverage, while an older car might only need basic coverage.

Budget:

- Determine how much you can afford to spend on auto insurance. While it's essential to have adequate coverage, it's equally important not to exceed your budget. Balancing cost and coverage ensures you get the best value for your money.

State Requirements:

- Familiarize yourself with the minimum auto insurance requirements in your state. Understanding these legal obligations will help you establish a baseline for your coverage and avoid penalties or fines.

Personal Assets:

- Consider your personal assets and financial situation. If you have significant assets, you may want higher liability limits to protect yourself in the event of a lawsuit.

Coverage Types:

- Learn about different types of coverage, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Tailor your policy to provide adequate protection based on your needs and potential risks.

Deductibles:

- Decide on an appropriate deductible level. A higher deductible typically results in lower premiums but requires you to pay more out of pocket in the event of a claim.

Driving Record:

- Your driving history plays a role in determining your insurance rates. If you have a clean record, you may qualify for discounts, while a history of accidents or traffic violations could increase your premiums.

ALSO READ: Ride Secure: Unraveling the Best Harley Davidson Insurance Options in the UK

By carefully considering these factors, you can make informed decisions about the type and amount of coverage you need. This self-awareness will help you find affordable auto insurance that meets your specific requirements without sacrificing essential protection.

Comparing Quotes:

One of the most effective ways to unlock savings is by comparing quotes from multiple insurance providers. Different companies offer various rates and discounts based on their underwriting criteria. Utilize online comparison tools or work directly with insurance agents to gather quotes tailored to your specific needs.

Here are some key points to consider when comparing insurance quotes:

Coverage Options:

- Ensure that you are comparing quotes for similar coverage types and limits. Different policies may have varying inclusions and exclusions, so it's crucial to understand the details of each policy.

Deductibles:

- Compare the deductibles offered by different insurers. A higher deductible often results in lower premium costs, but it also means you'll pay more out of pocket in the event of a claim. Choose a deductible that aligns with your budget and risk tolerance.

Discounts:

- Inquire about available discounts. Insurance companies may offer various discounts based on factors such as a good driving record, bundling multiple policies, safety features in your home or car, and more. Be sure to take advantage of all eligible discounts.

Customer Reviews and Reputation:

- Consider the reputation and customer reviews of each insurance provider. Look for feedback on their claims process, customer service, and overall satisfaction. A provider with good reviews may be more reliable in the long run.

Financial Stability:

- Assess the financial stability of the insurance companies you're considering. A financially stable insurer is more likely to fulfill its obligations and pay claims promptly. You can check financial ratings from independent agencies to gauge the stability of the insurance providers.

Ease of Communication:

- Evaluate the ease of communication with each insurance provider. Consider factors such as online account management, customer support availability, and the efficiency of claims processing. A responsive and accessible insurer can make your experience smoother.

Policy Exclusions and Limits:

- Pay attention to any exclusions and coverage limits in each policy. Understanding these details will help you avoid surprises when you need to make a claim. Make sure the policy aligns with your specific needs and potential risks.

Quotes Periodically:

- Insurance rates can change over time, so it's advisable to compare quotes periodically, even if you're satisfied with your current coverage. This ensures that you continue to get the best value for your insurance needs.

By carefully considering these factors, you can make an informed decision and choose an insurance policy that not only fits your budget but also provides the coverage and service you require.

Leveraging Discounts:

Insurance providers offer a multitude of discounts that can significantly reduce your premium. These may include safe driver discounts, multi-policy discounts, and good student discounts. Be sure to inquire about all available discounts and take advantage of those applicable to your situation.

Here are some common types of discounts that insurance providers often offer:

- Safe Driver Discounts: If you have a clean driving record without any accidents or traffic violations, you may qualify for a safe driver discount. Insurance companies reward policyholders who demonstrate responsible and safe driving habits.

- Multi-Policy Discounts: Bundling different insurance policies with the same provider, such as combining auto and home insurance, can often lead to a multi-policy discount. This can result in substantial savings compared to having separate policies with different providers.

- Good Student Discounts: Students who maintain good grades may be eligible for good student discounts. Insurance companies consider students with a high GPA as responsible individuals, which may translate to lower insurance risks.

- Military Discounts: Some insurance providers offer discounts to military personnel and veterans as a gesture of appreciation for their service. If you are in the military or a veteran, inquire about any specific discounts that may apply.

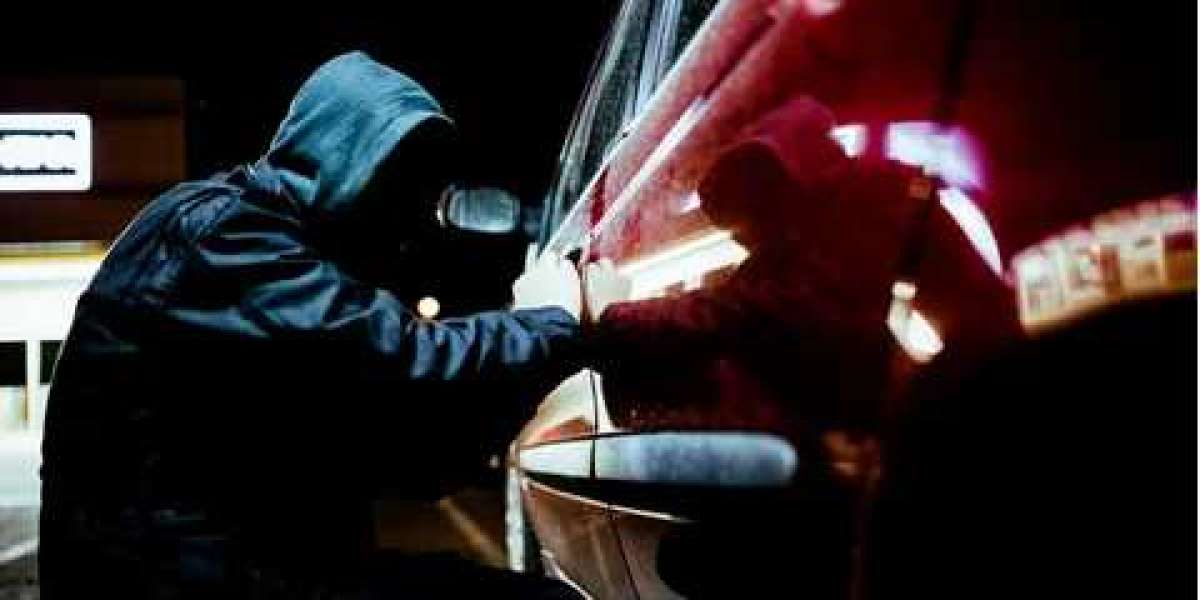

- Anti-Theft Discounts: If your vehicle is equipped with anti-theft devices or features, such as an alarm system or tracking device, you may qualify for an anti-theft discount. These measures reduce the risk of theft or vandalism, making your vehicle less of a liability to the insurer.

- Low Mileage Discounts: If you don't drive your car frequently, you may be eligible for a low mileage discount. Insurance companies often consider lower mileage as a lower risk, as it reduces the likelihood of accidents.

- Defensive Driving Course Discounts: Completing a defensive driving course can make you eligible for a discount. These courses teach advanced driving skills and safety techniques, which can make you a safer driver in the eyes of the insurance company.

- Occupational Discounts: Some professions may qualify for specific occupational discounts. For example, certain professions that are deemed low-risk may be eligible for reduced premiums.

When shopping for insurance, be sure to inquire about all available discounts and provide accurate information about your circumstances to ensure you receive the discounts you qualify for. Additionally, it's a good idea to periodically review your policy and check for new discounts that may have become available since your last renewal.

Maintaining a Good Driving Record:

Your driving record plays a pivotal role in determining your insurance premium. By maintaining a clean driving record, free of accidents and traffic violations, you can qualify for lower rates. Safe driving not only keeps you and others on the road safe but also helps unlock long-term savings on your auto insurance.

Choosing the Right Deductible:

Selecting the right deductible is a balancing act between your immediate budget and long-term savings. A higher deductible typically results in a lower premium but requires a higher out-of-pocket expense in the event of a claim. Evaluate your financial situation to find the optimal deductible that aligns with your budgetary goals.

Exploring Usage-Based Insurance:

Many insurance providers now offer usage-based insurance programs that track your driving habits through telematics devices or mobile apps. Safe driving behaviors can lead to substantial discounts. Consider opting for a usage-based insurance policy if you are confident in your ability to maintain safe driving habits.

Reviewing and Updating Coverage Annually:

As life circumstances change, so do your insurance needs. It's essential to review and update your coverage annually to ensure you're not paying for unnecessary features or, conversely, underinsured. Regularly reassessing your policy allows you to align your coverage with your current situation and potentially uncover additional savings.

Conclusion:

Affordable auto insurance in 06519 is within reach for those willing to navigate the insurance landscape strategically. By understanding your coverage needs, comparing quotes, leveraging discounts, and maintaining a good driving record, you can unlock substantial savings without compromising on protection. Keep these tips in mind as you embark on your journey to find the ultimate affordable auto insurance solution in 06519.

Esther Chikwendu 5 w

Good