In the competitive landscape of insurance providers, Mendota Insurance stands out as a beacon of excellence, going above and beyond the conventional offerings of policies.

In this article, we unveil the insider secrets behind Mendota's unparalleled success and explore how they consistently deliver more than just insurance coverage.

Customer-Centric Approach:

Mendota Insurance places customers at the core of its operations. Unlike many insurance providers that may seem impersonal, Mendota fosters a culture that prioritizes individual needs. Through personalized customer service, they build lasting relationships, ensuring clients feel valued and understood.

key aspects of a customer-centric approach as described in the provided information about Mendota Insurance:

- Customer-Focused Culture: Mendota Insurance has cultivated a culture that revolves around the customer. This means that employees at all levels of the organization are trained and encouraged to prioritize customer needs. This cultural emphasis on customer satisfaction sets the tone for the entire company.

- Personalized Customer Service: The company goes beyond generic or standardized services. Instead, it tailors its services to meet the specific requirements of each customer. This may involve understanding unique circumstances, preferences, and challenges that individual clients face.

- Building Lasting Relationships: Mendota Insurance aims to build long-term relationships with its clients. This goes beyond transactional interactions and focuses on creating a connection that extends beyond a single policy or claim. Building trust and loyalty are essential components of this relationship-building process.

- Client Valuation and Understanding: The company strives to ensure that clients feel valued and understood. This implies a commitment to active listening, empathy, and responsiveness. Understanding the customer's perspective allows Mendota Insurance to provide better-tailored solutions.

- Customized Solutions: Instead of offering one-size-fits-all solutions, Mendota Insurance likely provides customized insurance plans and services. This approach recognizes that different customers have different needs, and tailoring solutions accordingly enhances customer satisfaction.

- Feedback Mechanisms: A customer-centric approach often involves actively seeking and incorporating customer feedback. Mendota Insurance may have mechanisms in place to gather insights from customers, allowing the company to continuously improve its services based on the evolving needs and expectations of its client base.

ALSO READ: Ride Secure: Unraveling the Best Harley Davidson Insurance Options in the UK

A customer-centric approach at Mendota Insurance involves creating a culture that revolves around the customer, offering personalized services, building lasting relationships, and actively valuing and understanding individual clients. This strategy aims to differentiate Mendota Insurance from competitors by providing a more personalized and satisfying customer experience.

Tailored Solutions for Diverse Needs:

Understanding that one size does not fit all, Mendota Insurance provides a wide array of insurance products tailored to meet the unique needs of their diverse clientele. Whether it's auto, home, or specialty insurance, Mendota crafts solutions that align with individual circumstances, providing comprehensive coverage and peace of mind.

Here's how Mendota Insurance ensures tailored solutions for diverse needs:

- Customization: Mendota understands that each client's situation is different. They focus on customization, allowing clients to choose coverage options that best suit their specific needs. This may involve tailoring policies based on factors such as lifestyle, assets, and personal preferences.

- Comprehensive Coverage: Whether it's auto, home, or specialty insurance, Mendota ensures that their policies provide comprehensive coverage. This means addressing specific risks and potential challenges that individuals may face in their particular circumstances. By offering well-rounded protection, Mendota aims to give clients peace of mind.

- Individual Assessment: Mendota Insurance takes the time to conduct individual assessments for their clients. By understanding the unique risks and requirements of each customer, they can recommend and implement solutions that offer the right level of coverage. This may involve evaluating factors like driving habits, property characteristics, or specialized coverage needs.

- Flexibility: The insurance products provided by Mendota are designed to be flexible. This flexibility allows clients to make adjustments to their policies as their circumstances change. Whether it's adding new drivers, modifying coverage limits, or adapting to lifestyle changes, Mendota's tailored solutions can evolve with the client's needs.

- Specialty Insurance: In addition to standard auto and home insurance, Mendota recognizes that some clients may have unique needs that require specialized coverage. By offering specialty insurance options, they can cater to a diverse range of situations, ensuring that clients in various industries or with specific assets receive the protection they require.

- Responsive Customer Service: Mendota Insurance emphasizes responsive customer service. This means that clients can easily reach out for support, clarification, or adjustments to their policies. A proactive and attentive customer service approach ensures that clients feel confident in their insurance choices and have the information they need to make informed decisions.

Mendota Insurance stands out by acknowledging the diversity of their clientele and providing tailored solutions. Through customization, comprehensive coverage, individual assessments, flexibility, specialty insurance options, and responsive customer service, Mendota aims to address the unique needs of each client, fostering trust and confidence in their insurance offerings.

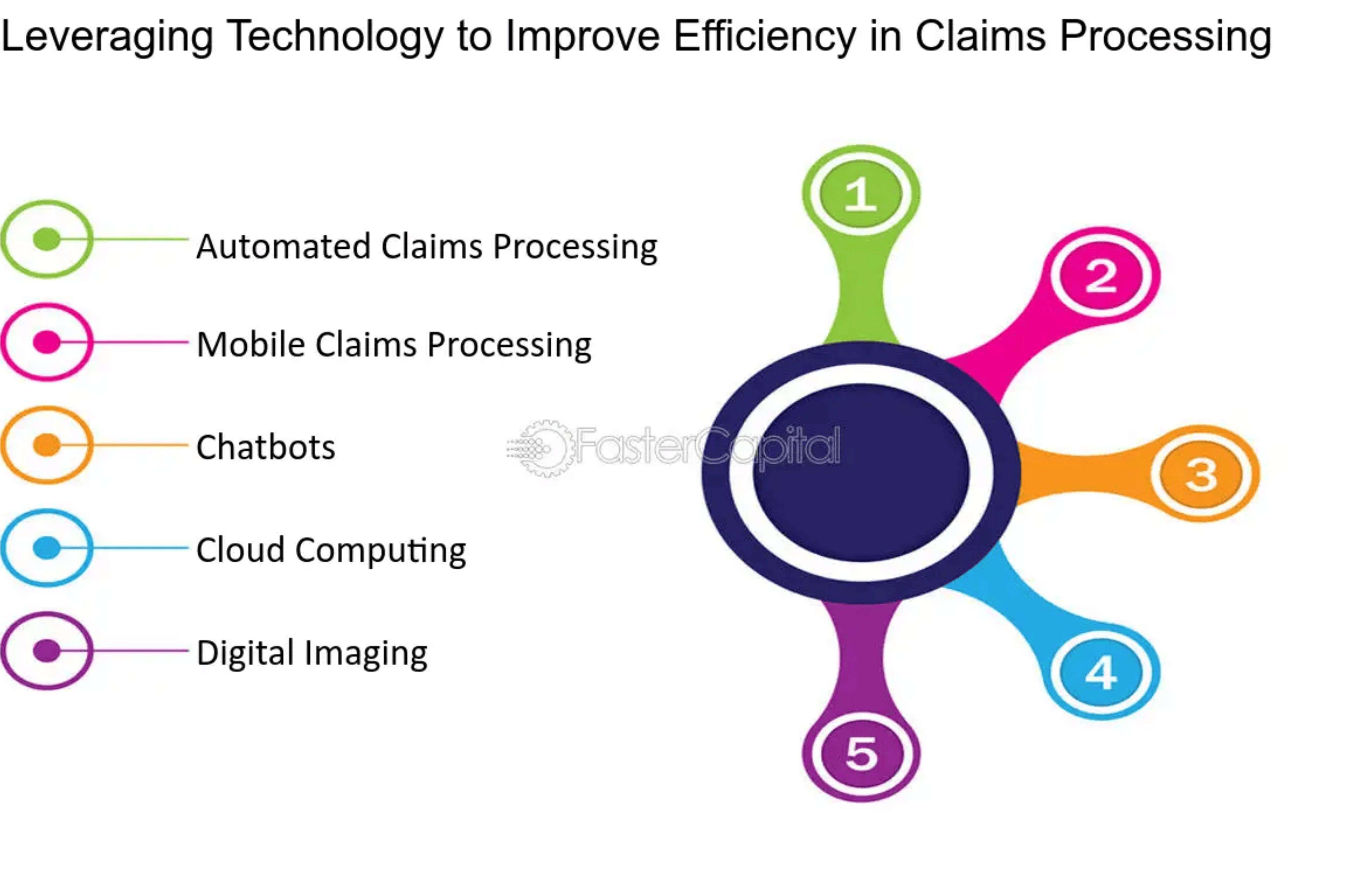

Efficiency in Claims Processing:

The speed and efficiency with which an insurance company handles claims can significantly impact customer satisfaction. Mendota Insurance stands out for its streamlined claims processing system, leveraging cutting-edge technology to expedite the resolution of claims. This commitment to efficiency minimizes stress for clients during already challenging times.

Here are a few points that emphasize the importance of efficiency in claims processing:

- Customer Satisfaction: A quick and efficient claims processing system is directly linked to customer satisfaction. Clients appreciate insurance companies that can promptly handle their claims, reducing stress and inconvenience during challenging situations such as accidents or property damage.

- Technology Integration: The mention of cutting-edge technology suggests that Mendota Insurance has embraced modern tools and systems to automate and streamline the claims processing workflow. This can include features such as digital documentation, online claims submission, and automated communication channels.

- Reduced Processing Time: Efficiency implies a reduced processing time for claims. By leveraging advanced technology, Mendota Insurance likely minimizes bureaucratic delays, enabling a faster assessment and resolution of claims. This is particularly important for clients who may need financial assistance or repairs promptly.

- Stress Minimization: Dealing with insurance claims can be stressful for policyholders. A company that prioritizes efficiency in claims processing helps alleviate stress for clients, contributing to a positive overall experience with the insurance provider.

- Competitive Advantage: A reputation for fast and efficient claims processing can serve as a competitive advantage in the insurance industry. Clients are more likely to choose or stick with an insurance provider that has a track record of handling claims quickly and effectively.

- Resource Optimization: Streamlined processes often result in resource optimization for the insurance company. By reducing manual interventions and streamlining workflows, Mendota Insurance may be able to allocate resources more effectively, ultimately benefiting both the company and its clients.

In summary, an insurance company's commitment to efficiency in claims processing, as highlighted by Mendota Insurance, reflects a dedication to providing excellent customer service, reducing stress for policyholders, and staying competitive in the industry through the integration of advanced technologies.

Transparent Communication:

In an industry where clarity can sometimes be elusive, Mendota Insurance excels in transparent communication. They go the extra mile to ensure policyholders fully understand the terms of their coverage, providing clear and concise information. This transparency builds trust, fostering a strong bond between the insurer and the insured.

Here are a few reasons why transparent communication is crucial in the insurance industry:

- Clarity and Understanding: Insurance policies can be complex, filled with legal and technical language that may be challenging for policyholders to grasp. By providing clear and concise information, Mendota Insurance helps policyholders better understand the terms and conditions of their coverage. This clarity can prevent misunderstandings and disputes in the future.

- Informed Decision-Making: Transparent communication empowers policyholders to make informed decisions about their insurance coverage. When individuals have a clear understanding of what is covered and what is not, they can choose the right policy for their needs. This helps in avoiding dissatisfaction and disappointment when making a claim.

- Trust Building: Trust is a crucial element in the relationship between insurers and policyholders. When an insurance company is transparent about its policies, it demonstrates a commitment to honesty and openness. This, in turn, builds trust and confidence among policyholders, who feel more secure in their choice of insurer.

- Reduced Risk of Complaints and Disputes: Miscommunication or lack of clarity can lead to policyholder dissatisfaction, complaints, and even legal disputes. Transparent communication reduces the risk of such issues by ensuring that policyholders are well-informed from the start. This proactive approach can save time and resources for both the insurer and the insured.

- Customer Satisfaction: When policyholders fully understand their coverage and feel confident in their insurer's communication, they are more likely to be satisfied with their overall insurance experience. Satisfied customers are more likely to renew their policies and recommend the insurer to others, contributing to the company's long-term success.

Mendota Insurance's emphasis on transparent communication is a positive practice in the insurance industry. It not only benefits policyholders by providing clarity and understanding but also strengthens the relationship between the insurer and the insured, fostering a culture of trust and satisfaction.

Embracing Technological Advancements:

Mendota Insurance stays ahead of the curve by embracing technological advancements in the insurance industry. From user-friendly online portals to mobile apps that simplify policy management, their commitment to innovation enhances the overall customer experience.

Community Engagement and Social Responsibility:

Beyond providing insurance, Mendota actively engages with the communities it serves. Through various initiatives and philanthropic efforts, the company contributes to social causes, showcasing a commitment to corporate social responsibility. This involvement resonates positively with clients who appreciate a company that gives back.

Continuous Improvement and Adaptability:

Mendota Insurance doesn't rest on its laurels. The company is constantly evolving and adapting to meet the ever-changing needs of its clients and the dynamic insurance landscape. This commitment to continuous improvement ensures that Mendota remains a leader in the industry.

Conclusion:

Mendota Insurance stands as a shining example of an insurance provider that delivers more than just policies. By prioritizing customer needs, offering tailored solutions, embracing technology, and engaging with communities, Mendota sets a standard for excellence in the industry. Their insider secrets reveal a dedication to not only protecting assets but also enriching the lives of those they serve.

Esther Chikwendu 5 w

Great