tickmill broker review

- It Tickmill Secured?

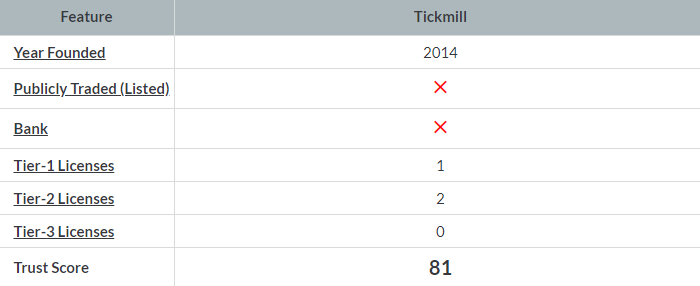

Tickmill has an overall Trust Score of 81 out of 99, which means it’s safe. Tickmill is not traded on the stock market and does not run a bank. It has been approved by a high-trust tier-1 regulator, two tier-2 regulators ”medium level of trust”, and the ”zer0” tier-3 regulators (low trust). One of Tickmill’s top regulators is the Financial Conduct Authority, which is a Tier 1 regulator (FCA). Find out more about the Trust Score.

Comparison of Regulations

- Investments availability

Tickmill provides CFDs on currency pairs, indices, metals, bonds, and cryptocurrencies, totaling 85 tradeable symbols. Additionally, futures and options traders have access to at least 62 different symbols via a separate account. Tickmill clients can choose from a variety of investment options in the following table.

Tickmill offers cryptocurrency trading via CFDs, but not directly through the underlying asset (e.g. buying Bitcoin). Nota bene: Cryptocurrency CFDs are not available to retail traders or residents of the United Kingdom through any broker’s United Kingdom entity.

- Tickmill investment offering

- Fees and commissions

”Classic, Pro, and VIP” are the three types of Tickmill accounts available. The bottom line is that Tickmill is the ideal option both active as well as VIP traders because it offers pricing that is competitive with lowest cost broker in the market.

”Traders only pay the bid/ask spread on the Classic account” The Classic account’s typical spreads, on the other hand, are significantly higher than those of Tickmill’s other two account categories.

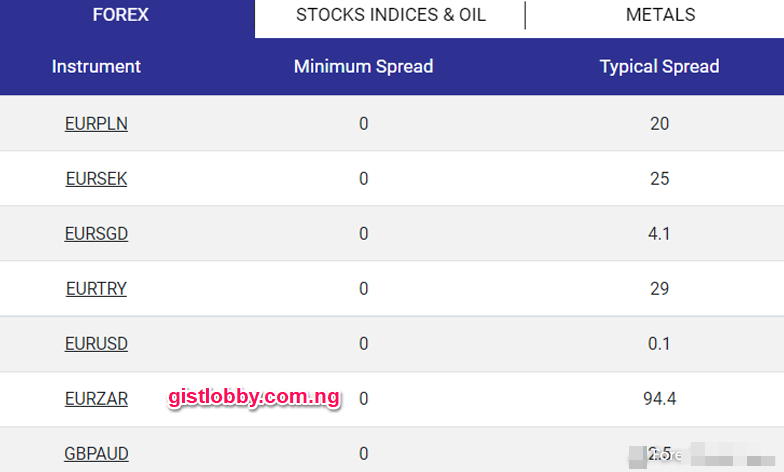

As of September 2021, Tickmill’s Pro account has an usual spread of 0.07 pips for the EUR/US dollar. Adding the RT commission equivalent of 0.4 pips ”$2 US dollar per side” brings the total cost to 0.47 pips;. Tickmill also records typical spread data during normal market situations ”when spreads are narrower”.

Each time you make a trade with a Pro or VIP account, you pay a small fee. This fee is added to the lower spreads that are already there. ” The Pro account” is appropriate for the majority of traders due to its low fee rate, minimal spreads, and wide selection of 75 instruments and 62 currency pairings.

VIP vs. Pro accounts: Traders who choose Tickmill’s VIP account must maintain a minimum balance of $50,000, but they will benefit from the firm’s cheap commissions of $1 each normal lot (100,000 units) or $2 per Round-Turn (RT) – and effective spreads of 0.27 pips after commissions. While the Pro account requires only a $100 deposit, commissions are doubled to $4 each round-turn standard lot.

Discounts for active traders: Tickmill offers three tiers of rebates for active traders, starting at $0.25 per standard lot (up to 1,000 standard lots per month) and increasing to $0.75 per standard lot at tier-3 for traders who trade more than 3,001 standard lots per month.

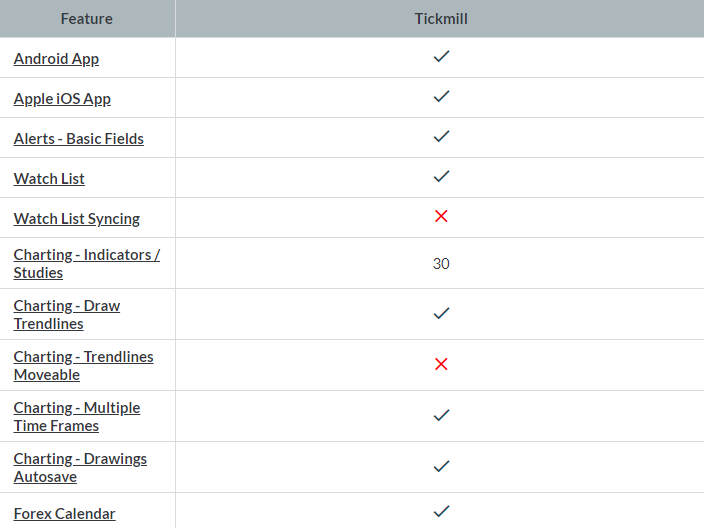

- Apps for mobile trading

As a MetaTrader-exclusive broker, Tickmill includes iOS and Android versions of the MT4 and MT5 apps (the latter of which is exclusively available in the United Kingdom), which are both available for download from the Apple App Store and Google Play Store. It’s worth noting that Tickmill just created a specialized mobile application dedicated exclusively to account administration (no trading).

- Other trading systems are available

As Tickmill continues to establish itself as a multiasset broker, the company’s U.K. and EU entities have launched MT5 and added TradingView to their respective product suites. As part of its expansion, Tickmill has recently integrated the CQG platform for futures and options trading (U.K.-only). Tickmill has made significant progress in the growth of its platform services, putting it in direct rivalry with the industry’s leading brokers – despite the fact that it does not have its own platform.

Brief description of the trading platforms: Tickmill is a MetaTrader-only broker that provides the normal out-of-the-box experience for both MT4 and MT5 traders. Futures and options traders in the United Kingdom can use the CQG platform, while TradingView – a prominent web platform noted for its excellent charting – can be linked to your Tickmill account for futures and options trading (although I was not able to do this during our testing).

A number of important add-ons are available from FX Blue as part of the Advanced Trading toolkit package, and Tickmill has also added Autochartist connectivity as a part of their trading platform. Tickmill also offers virtual private server (VPS) hosting, which is a handy tool for algorithmic traders.

- Tickmill platform for trading

- Conduct market research

Tickmill is a market research provider that is competitive and continues to improve in this field year after year. Having said that, Tickmill continues to fall short of industry leaders such as IG and Saxo Bank in terms of depth, personalisation, and overall quality.

Tickmill publishes daily articles on its Expert Blog including technical and fundamental analysis, in addition to video updates on its YouTube channel. Tickmill’s third-party research tools are particularly impressive; the Autochartist plugin enables automatic technical analysis, forex news headlines are streamed from Investing.com, and the economic calendar is powered by Myfxbook. Tickmill also distributes content via social media platforms, including a dedicated Facebook group and a Telegram channel.

As far as news and commentary go, Tickmill does an excellent job at providing both.

The Weekly Live Markets Trade Analysis series, which analyzes market fundamentals, is combined with pieces on technical analysis.

Tickmill also has ”archived webinars” technical and fundamental analysis videos, news updates on its YouTube channel,

Tickmill also has ”archived webinars” technical and fundamental analysis videos, and news updates on its YouTube channel;

Finally, Tickmill’s website offers sentiment data from the CME and Acuity Trading, as well as widgets that include both sources.

In addition to the native MetaTrader Signals market, Tickmill provides three social copy-trading platforms that are directly linked to your MetaTrader account. Pelican Trading and Myfxbook’s AutoTrade function are available at the firm’s U.S. and EU branches, but not in the UK and EU. Tickmill does not actively promote ZuluTrade for copy trading, but it is available.

- Research on Tickmills

- Tickmill Education

Tickmill’s educational content is roughly on line with what the industry offers on a consistent basis. While Tickmill does provide access to a big collection of recorded webinars, it is lacking in educational videos and articles.

The learning center has live educational classes, a selection of informative eBooks and infographics, and weekly webinars in a variety of languages that are archived on YouTube. Additionally, Tickmill’s website include instructional materials for learning about futures, which are powered by the CME.

Tickmill’s educational offering continues to grow in scope and variety of media. However, it currently lacks video material and textual pieces are few and few between. Creating a separate educational portal that allows for content filtering according to expertise level would be a significant organizational improvement. Some of the finest brokers offer lesson plans that include quizzes and progress tracking — things that Tickmill does not yet offer.

- Conclusion

Tickmill is most beneficial to traders with a high volume of transactions and a large balance who want to trade just the most popular FX and CFD instruments. Tickmill combines its MetaTrader offering with a robust selection of copy trading platforms and a choice of account types with varied pricing structures.

Consider its disadvantages, which include a limited market reach, a dearth of research information, and subpar educational content. While the VIP account’s pricing is extremely competitive, traders might examine other forex brokers in 2022.

Alphonsus Odumu 3 w

Tickmill