Rocket Mortgage overview

Rocket Mortgage is one of the best online mortgage companies in the United States. Loans from eight to 29 years in length are available, as is the option of taking cash out of the property in the form of a "YOURgage," which the lender gives to customers who want to buy or refinance. Dan Gilbert started Rocket Mortgage's parent company, Quicken Loans, in 1985. The company is based in Detroit, and Gilbert is now the chairman. In recent years, the lender became well-known because it started using technology that lets people apply for loans online. In 2021, Rocket Mortgage became the official name of Quicken Loans.

Good for

borrowers who want to easily compare rates, find out more about the mortgage process, and apply for a loan all online.

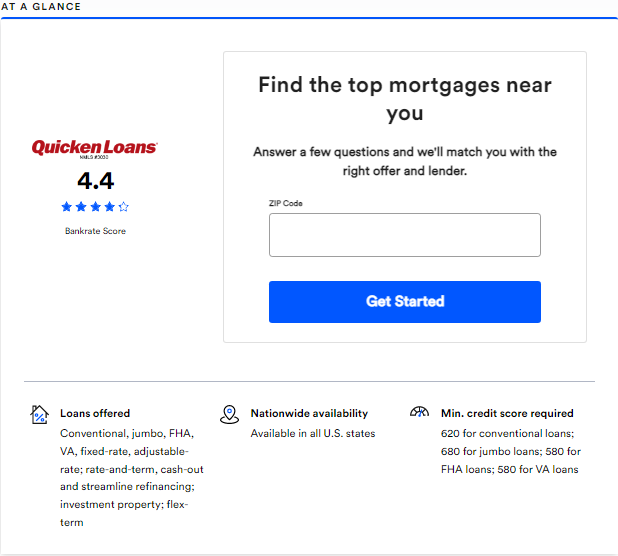

Loan kinds

- Conventional

- Jumbo

- FHA

- VA

- Fixed-rate

- Adjustable-rate

- Rate-and-term, cash-out, and simplified refinancing

- Investing in real estate

- Flex-term

Lender fees

An origination charge, rate-lock fee, and other closing costs may be included in Rocket Mortgage's lender fee structure. These costs can change based on the type of loan, taxes, and other things.

Rates

On its website, Rocket Mortgage shows mortgage rates, which are changed every day. The rates provide an explanation of how the rate has changed over the course of the previous day as well as over the course of the previous year.

Reputation

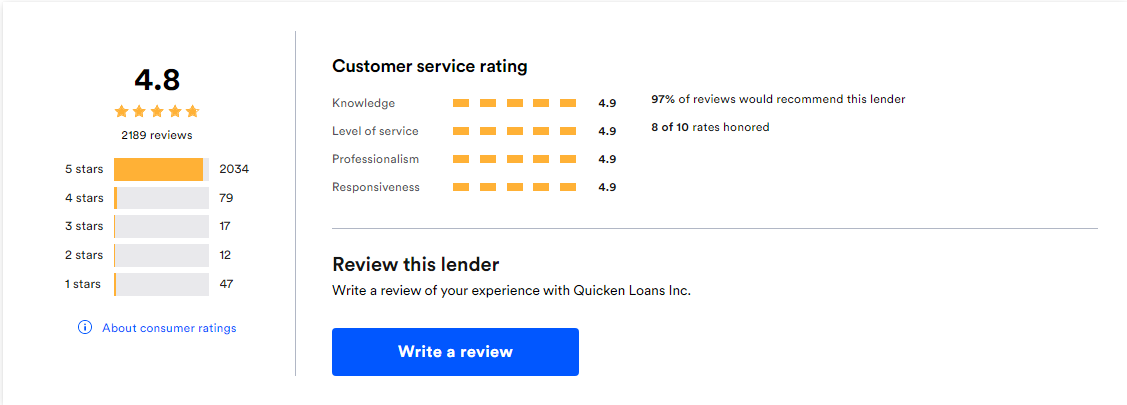

Trustpilot has given Rocket Mortgage 3.9 stars out of a possible 5. In 2021, J.D. Power put it in second place in terms of customer satisfaction when it came to getting a mortgage.

Web services

Borrowers can request a "Prequalified Approval" from Rocket Mortgage, which merely looks at your credit, or a "Verified Approval," which looks at your income and assets. Once you've created an account, you'll be prompted to enter information on the loan and property in issue, as well as your own credit and financial history. You can e-sign the application and keep track of your loan with the Rocket Mortgage app. If you want to learn more about your options, Rocket Mortgage's website has a large library of educational articles and a number of calculators.

Minimum requirements for borrowers

According to the conforming loan standards of Fannie Mae and Freddie Mac as well as those of the Federal Housing Administration (FHA) and Veterans Affairs, Rocket Mortgage generally adheres to (VA).

A solid credit score (usually a FICO score of 620 or above) and a minimum down payment of 3% are essential for conventional loans. The borrower's debt-to-income ratio (DTI) can't be more than 50%.

These rules are set by the government for FHA and VA loans. Here's where you can find them:

Getting a new loan through Rocket Mortgage

After making an account, you can use the Rocket Mortgage website or app to apply for a refinance.

Is Rocket Mortgage the appropriate fit for your financial situation? Think about these other options

- Review of LoanDepot, an online lender that will pay back the appraisal fee if you refinance again.

- Freedom Mortgage is another high-volume lender that offers loans and programs for people who want to buy their first home.

- A review of Mr. Cooper: Has an app that lets you check on the status of your loan application and make payments

- United Wholesale Mortgage is one of the best wholesale lenders if you are working with a mortgage broker.

- Review of the Costco Mortgage Program, which is a marketplace where Costco members can get discounted fees through partnerships with different mortgage lenders.

Scores for each part of Rocket Mortgage's review

- Cost: 4 out of 5

- Availability: 4.3/5

- Experience as a borrower: 5/5

MORE ARTICLES

What is mortgage refinancing? How does it work?

Bitcoin drops below $29,000 Is there more dip after a bullish trend?

Levels of Support and Resistance How to Use Them to Trade Crypto?

Review methodology

According to the Bankrate editorial team's ratings of mortgage lenders on a scale of one to five stars, each lender's goods and services are taken into consideration when calculating the Bankrate Score. We get paid by Bankrate's partners, but our reviews are our own, and those relationships don't change how we write them. Here is how we do everything.

Reviews from Rocket Mortgage customers

people found this review helpful.

Bankrate.com's (Bankrate) customer evaluations are not the opinions of Bankrate, but rather the opinions of the reviewers themselves. Reviewers' views and replies to reviews are their own. Bankrate does not agree with or support them in any way.

To provide you with the most relevant information, the consumer reviews presented below are limited to those that this advertiser has received in the last year.

The process is simple and quick.

A. Leo Venuti | Onset, MA | July 27, 2021

A simple procedure was followed. After the initial phone call, almost everything is completed online. Starting with them, Amrock takes care of the rest. I got a 2.99% cash out refinance. For roughly six weeks, it took place. On schedule, they transferred my money into my bank account. Mortgage payments are lower than they were before... Show a little more

No, they are not.

Is this a resounding "yes"?

Would I suggest it?

Yes, we were done on schedule.

I LOVE THIS COMPANY!! OUR MOOD IS SUCCESSFUL.

BUYING A HOME WAS NEW TO US. Everything went smoothly | Westerchester, Illinois | October 13, 2021

Using Rocket Mortgage was a terrific experience for us. When we applied for our VA loan, we received an excellent interest rate and it was processed quickly. I truly enjoy being able to monitor the progress of my order online. I was able to quickly share a document I needed to someone via uplo... Show a little more

No, they are not.

Is this a resounding "yes"?

Would I suggest it?

Yes, we were done on schedule.

CHECK OUT: https://study.twistok.com/2022/02/25/top-25-funded-international-student-scholarships-in-the-usa/

Enobong Bassey 2 yrs

Thanks