In light of this, the issue arises as to why retail investors are not interested in Bitcoin considering the current state of the market. Nevertheless, the most recent investigation that was carried out by the BIS has shed light on the subject issue.

Report Made Available by the BIS

The Bank for International Settlements (BIS) has only lately disseminated the findings that it obtained from an investigation that it conducted into the cryptocurrency sector.

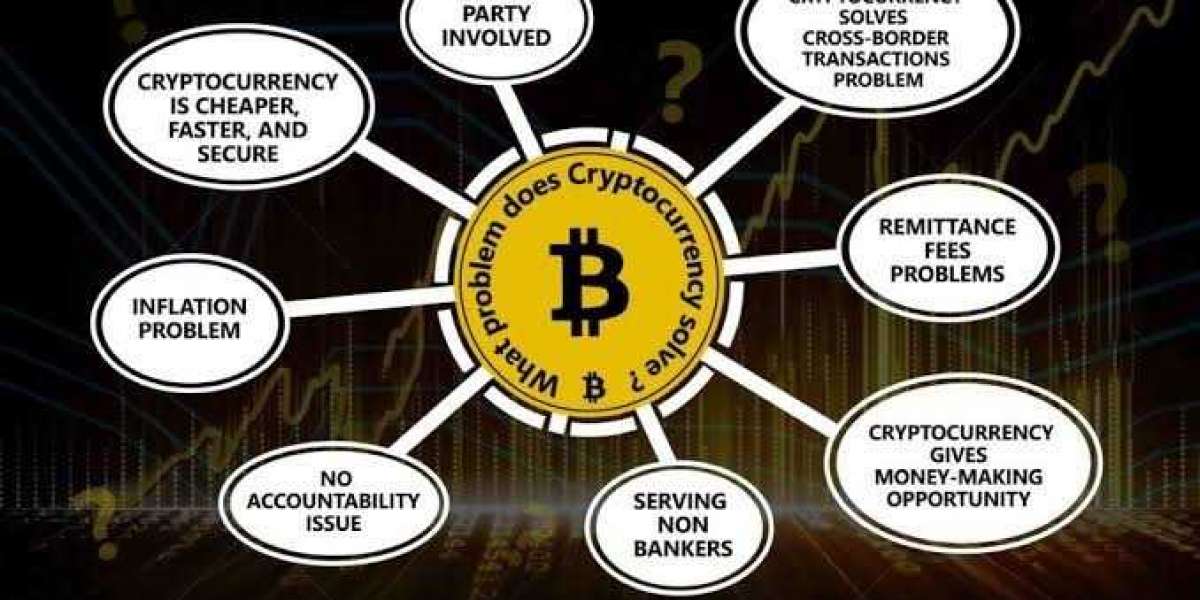

The analysis sheds light on the widespread belief that investors are gravitating toward cryptocurrencies in order to escape the constraints imposed by conventional banking systems.

The conduct of ordinary investors with regard to cryptocurrency investments is also confirmed by the research. It displays the specific time at which retail investors wish to start investing in cryptocurrencies.

Both of these interpretations converge on a single objective, which is accomplished by investors as a result of their participation in bitcoin trading.

Increasing prices are something that investors are interested in.

According to the findings of the survey, investors' aversion to traditional financial institutions is not the driving force behind their purchase of cryptocurrency. They do this because they are drawn to the growing values of cryptocurrencies, which is the primary reason they invest in them.

Companies dealing in cryptocurrencies have, for a considerable amount of time, maintained that traditional banking methods are unpopular among consumers. People are gravitating toward cryptocurrencies because the cryptocurrency industry provides both independence and anonymity.

When referring to those who put money into cryptocurrency as a store of value, cryptocurrency companies often use this justification as their rationale.

However, the findings of the study conducted by the BIS have clearly demonstrated that the price of cryptocurrencies is what draws in investors. The cryptocurrency market is widely acknowledged as the most volatile trading sector currently available.

Cryptocurrency investments have the potential to generate enormous returns for their owners, potentially turning them into millionaires in a matter of seconds. This is the primary reason why individuals and retail investors are interested in cryptocurrency.

Working Papers from the BIS

On November 14, the Bank for International Settlements (BIS) disseminated the working papers that revealed the connection between retail adoption, crypto trading, and Bitcoin prices.

According to the findings of the study, the number of people downloading cryptocurrency trading applications skyrockets whenever there is a significant increase in the price of Bitcoin.

These are the instances in which the trading activities of digital assets have significantly increased, which has resulted in a significant upward push for the prices of cryptocurrencies.

According to the findings of the study, the number of people downloading cryptocurrency trading applications reached a high point whenever BTC hit all-time highs. Between July and November of 2021, these events were Bitcoin's price reaching $50,000, then $60,000, and finally $69,000.

This is further evidence that investors are not opposed to traditional banking institutions but rather are drawn to the high trading prices of Bitcoin and alternative cryptocurrencies.

In light of the most recent findings, the report makes the following forecast: in the event that the price of BTC rises above $25,000, then a significant rally will be formed. At this point, retail investors would enter the market and begin making significant investments.

Wisdom Nnebi 8 w

Hhahahaha