ChatGPT, the overwhelming, conversational, large language model (LLM) artificialintelligence(AI) success created by OpenAI, has assumed a new role in American society: that of a stock market expert.

In a survey of 2,000 Americans conducted by the investment advice website The Motley Fool, 47% of US adults reported consulting ChatGPT for stock market advice. In a harbinger of things to come, 45% of respondents said they would be comfortable relying solely on AI models for stock selection.

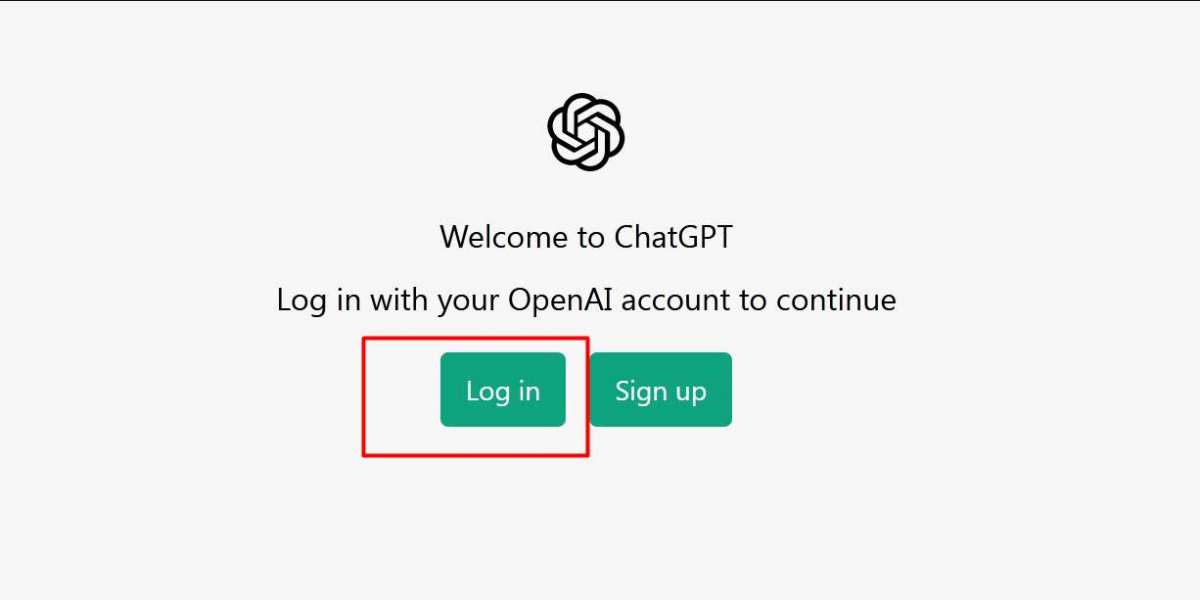

ALSO READ:How to use ChatGPT to build an application

Hopefully, all survey respondents are aware that ChatGPT-3.5 was trained on internet content through 2021. ChatGPT Plus, powered by GPT-4, would cost them if they wanted to be more in tune with the current market.

Even so, GPT-4 has become obsolete. There is no system in place to input generative language AIs with new and dynamic information from the internet, such as stock price or interest rate fluctuations. Therefore, if you're considering day trading, this would not be a good strategy.

Who consults AI for investment guidance?

However, for those interested in slightly broader movements, ChatGPT appears to perform admirably, and younger Americans, including a significant number of digital natives, have enthusiastically embraced AI for investment advice.

According to a survey conducted by The Motley Fool, fifty percent of Millennials and fifty-three percent of members of Generation Z utilized the AI LLM to discover stock recommendations. In contrast, only 25 percent of Baby Boomers, a generation that still recalls how fax machines and floppy discs operate, felt confident doing so.

Not surprisingly, the survey also discovered that income levels are good predictors of who uses the service for stock research. 77% of high-income Americans have utilized ChatGPT for investment advice, compared to 43% of middle-income Americans and 23% of low-income Americans.

Asit Sharma, an analyst with The Motley Fool, found that women, who have recently outperformed males as investors, tend to be more conservative in financial matters, being less impulsive and more composed during market volatility. Therefore, it is not surprising that only 41% of women utilized ChatGPT, compared to 55% of men.

A little more than two-thirds of American adults (69%) said they would contemplate using ChatGPT for investment advice in the future. Due to the democratization of a tool that even hedge fund traders are concurrently salivating over, this shift to artificial intelligence could result in a seismic shift in the economics of money management.

Nine out of ten hedge fund traders plan to use AI to manage their portfolios for the remainder of 2023, according to a recent survey of the top 50 hedge fund managers by London-based Market Makers.

Functions of ChatGPT

Already, the outlook is bleak for the moneymen and women, such as institutional fund managers, who control and endeavor to grow the vast assets of American savers.

A hypothetical fund of 38 stocks, chosen by ChatGPT and based on criteria (such as low debt, high growth) culled from the portfolios it was competing against, increased by 4.93 percent in the first eight weeks since its inception on March 6, 2023, compared to a -0.78 percent average posted by the 10 most popular funds in the UK. In fact, the hypothetical fund outperformed the top 10 on 34 out of 39 market days.

ALSO READ:125+ Top-Rated ChatGPT Prompts for Every Type of Workflow

A recent ChatGPT-based study conducted by the University of Florida may be the final nail in the coffin, as it suggests even more severe implications for fund managers worldwide.

In a paper published this week in the Social Science Research Network, professors Alejandro Lopez-Lira and Yuehua Tang describe how they decided to test ChatGPT's ability to conduct 'Sentimental Analysis' -- essentially determining stock-picking strategy by analyzing article headings.

Again, ChatGPT is not trained beyond September 2021, so researchers fed the AI model 67,586 headlines pertaining to 4,138 unique corporations between September 2021 and the present.

This type of analysis has been performed in hedge fund trading rooms for some time, but this was the first time ChatGPT was tested to perform duties nearly identical to expensive proprietary trading platforms and with sentiment analysis built in.

Using sentiment analysis, the ChatGPT trading model generated returns in excess of 500% during this period, compared to a return of -12% from purchasing and holding an S&P 500 ETF during the same time frame.

If that isn't poor news for the finance industry -- and entry-level research analysts in particular -- almost every day sees the emergence of new ChatGPT-integrable APIs and plug-ins.

PortfolioPilot, for instance, is a recently released and validated ChatGPT plugin that enables portfolios to be dumped into it for analysis and recommendations for no cost.

The days of paying mutual funds management fees for mediocre returns may be coming to an end, at least under the current structure, given AI's extant ability to outperform the most prestigious money managers.

Not possible with ChatGPT

All of this sounds like the investing equivalent of nirvana, but there are a few things to bear in mind before you begin trading with your favorite investing bot.

ChatGPT's training concluded in September 2021, so any questions you pose will not pertain to the time period since then. AI hallucinations are the result of generative AI's propensity to invent information when it does not know the answers to your queries.

By collecting data from pre-existing texts, generative AI is able to detect patterns extremely well. However, it is poor at causal reasoning, and its conversational skills could lead you astray. It is also poor at arithmetic. Consequently, information or insights must be double-checked to ensure their precision.

When viewing CEO or CFO interviews to determine the actual health of a company, many investigative journalists and stock pickers rely heavily on facial expressions.

According to investment professionals, while the report has impressed and enthralled with its refined responses, many of these recommendations are still far too general to be useful. It does not pose the kinds of sophisticated inquiries that a portfolio manager would.

ALSO READ:GPT 4: How to Use It? Chatgpt-4 Register, Login, GPT-4 Install App

Obviously, AI can improve at all of these tasks over time, and each successive version has proved to be astoundingly superior to the one that came before it. But we're not quite at investing nirvana yet.

And, when it gets there, we may have to deal with a slightly larger issue -- how do you make money in a market where information and analysis for any imaginable asset, anywhere in the world, is readily available at the command of artificial intelligence?

Angela Anayo Nzeh 1 w

Good one