Europe's energy crisis deepens as Russia further curbs natural gas exports and the region plunges into recession, forcing governments to spend billions of dollars to protect businesses and consumers from rising bills.

The benchmark natural gas price in Europe rose 28% to 274 euros ($272) per megawatt-hour on Monday morning, the first day of trading after Russian energy giant Gazprom discovered an oil leak and announced it had suspended indefinitely the flow through Nord Stream 1. pipeline. do not see. turbine. Last year, the pipeline supplied about 35 percent of Russia's total gas imports to Europe. Since June, however, Gazprom has cut electricity capacity by 20 percent along Nord Stream 1, citing maintenance issues and disputes over missing turbines due to Western export sanctions. Moscow's decision not to reopen the pipeline on Saturday sparked concerns in the European Union that it could run out of gas this winter despite successful attempts to fill the reservoirs. In Britain, natural gas futures rose by more than a third on Monday on similar concerns. On Friday's news of the pipeline's indefinite shutdown, the euro fell below a 20-year low of $0.99 on Monday. The pound was at its lowest level since 1985 at $1.14 as traders worried about the cost the energy shortage could have on local economic activity and government budgets. Some countries are prepared to spend more to contain the disease.

The German government on Sunday announced a 65 billion euro ($64 billion) aid package to help households and businesses cope with rising inflation. Germany, Europe's largest economy, is particularly dependent on Russian gas exports to power homes and heavy industry.

Berenberg chief economist Holger Schmieding said in a note on Monday that, combined with previous measures, the total government aid would be 95 billion euros ($64 billion), or about 2.5 percent of GDP- of Germany. Liz Truss, who will succeed Boris Johnson as British prime minister this week, is under intense pressure to announce more support for households and businesses as energy prices rise.

The trust is considering a 100 billion pound ($115 billion) package to help with the rising cost of living, including help to pay utility bills, The Sunday Times reported, citing an anonymous source at the Department of National Treasury. If so, it would cost about 30 billion pounds ($34 billion) more than subsidized workers' wages in the country's pandemic relief plan to avoid massive layoffs.

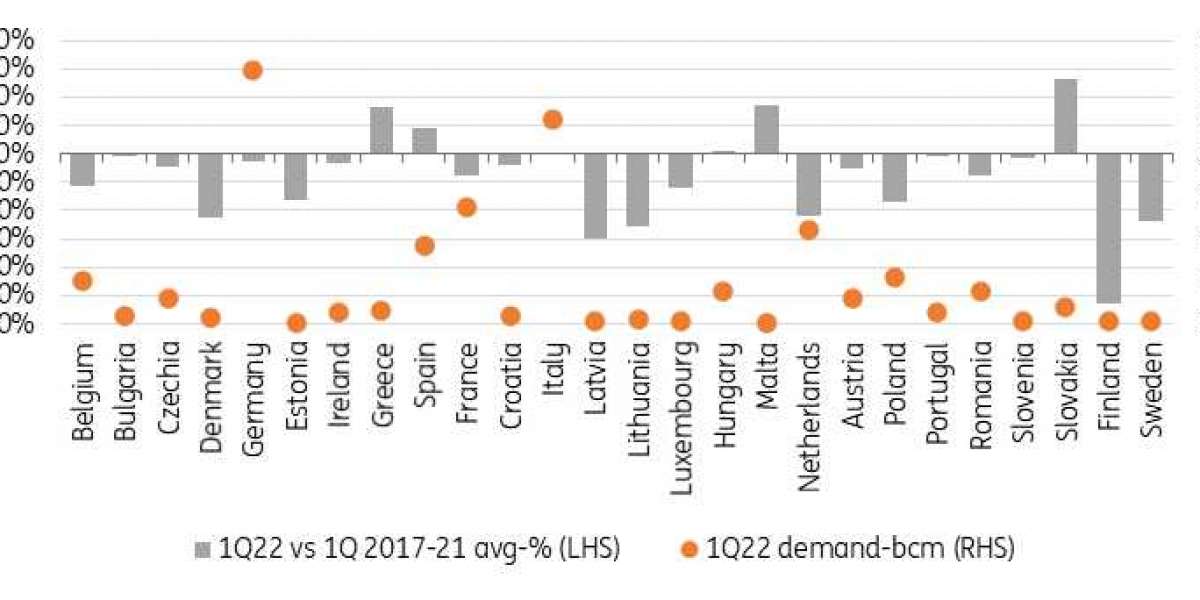

preparation for winter

Fearing that Russia will cut gas supplies further, the European Union has boosted its energy stocks for months in the cold season, when consumption is at its peak. Moscow has stopped sending gas to several "friendly" European countries and energy companies because it refused to pay for the gas in rubles, which the Kremlin demands, rather than euros or dollars specified in the contract. Friday's announcement of the Nord Stream 1 project comes hours after the G7 countries agreed to cap the price of Russian oil sales to reduce the revenue used by the Kremlin to finance the war in Ukraine. A spokesman for Siemens ( GCTAF ), the German maker of the faulty Nord Stream 1 turbines, said Friday that the oil leak was "not a technical reason for the shutdown."

"However, we have repeatedly stated that there are enough additional turbines at the Portovaya compressor station to run Nord Stream 1," the spokesperson told CNN. Due to energy shortages, EU countries quickly filled their gas reserves. According to Gas Infrastructure Europe, the store is now 82% full and more than 80% management has determined should reach the store by November. "Despite the serious threat of energy shortages, we still expect most of Europe to have a cold season without significant disruptions to industry with large-scale gas supply metering," Schmieding said in a memo. However, European leaders know that more action is needed to avoid widespread hardship and mitigate the effects of the recession. European Union energy ministers will hold an emergency meeting on Friday to discuss plans to protect Europeans from the worst rise in energy prices. Initial ideas include a mechanism to separate wholesale natural gas and electricity prices and a proposal to provide emergency loans to power companies on the brink of bankruptcy, according to a draft Reuters document.

More Article

https://twistok.com/read-blog/12466_g7-countries-agree-to-limit-the-price-of-russian-oil.html

Alphonsus Odumu 4 w

Energy crisis in Europe